Executive Summary

- US Iran conflict oil prices impact The News: As President Donald Trump openly weighs a “limited strike” on Iran to force diplomatic concessions, global energy markets are flashing red. Brent crude has surged past $71 a barrel, marking its highest point in nearly seven months.

- The Hidden Link: The true threat is not the destruction of oil fields, but the weaponization of logistics. Iran controls the northern edge of the Strait of Hormuz. A disruption here doesn’t just block Iranian oil; it traps the crude exports of Saudi Arabia, the UAE, Iraq, and Kuwait.

- The Outlook: While a full blockade remains unlikely, the geopolitical “risk premium” is already driving up fuel costs. For energy-hungry nations like India, a prolonged standoff could widen current account deficits, spike inflation, and severely squeeze domestic chemical and fertilizer supply chains.

The global economy is currently balancing on a 21-mile-wide strip of water.

In late February 2026, the rhetoric between Washington and Tehran escalated dramatically. The United States has surged naval and air assets into the Middle East, while Iran temporarily closed parts of the Strait of Hormuz during military drills. The market reaction was instant: oil prices spiked.

But behind the political posturing lies a complex web of economic dependencies. A military confrontation in the Persian Gulf is no longer just a regional security issue—it is a direct threat to the wallets of everyday consumers from Ohio to Mumbai. Here is a breakdown of the geopolitical math, the unique dilemma facing the US administration, and why India is uniquely exposed to the fallout.

The Core Analysis: The Strait of Hormuz as the Ultimate Lever

To understand the panic in the commodities market, you have to look at the geography.

The Strait of Hormuz is the world’s most critical energy artery. Every single day, approximately 20 million barrels of crude oil—roughly 20% of total global consumption pass through this narrow waterway. Furthermore, over 20% of the world’s Liquefied Natural Gas (LNG) relies on this exact same route.

If the US launches a strike, Iran has a potent asymmetric retaliation tool: disrupting maritime traffic.

While the US Navy maintains a robust presence to keep the shipping lanes open, even the threat of conflict is enough to send commercial maritime insurance premiums skyrocketing. Historically, a severe disruption in the Strait could easily push oil prices well beyond $90 or even $100 a barrel.

The Global Impact & “The Midterm Paradox”

For the United States, launching an attack presents a massive domestic political paradox.

President Trump has spent months boasting about falling gas prices, which recently dropped to an average of $2.80 a gallon before creeping back up to $2.92 amid the current tensions. With the US midterm elections looming in late 2026, affordability is the single most vulnerable issue for the incumbent party.

- The Inflation Trap: If a strike on Iran sends Brent crude to $80 or $90 a barrel, US gasoline prices will rapidly cross back over the psychological $3.00-a-gallon threshold.

- The Tariff Multiplier: American consumers are already absorbing the costs of the newly implemented 10% global import tariffs. Layering an energy-driven inflation spike on top of higher imported goods costs could trigger severe voter backlash, effectively making a military strike an act of political self-sabotage.

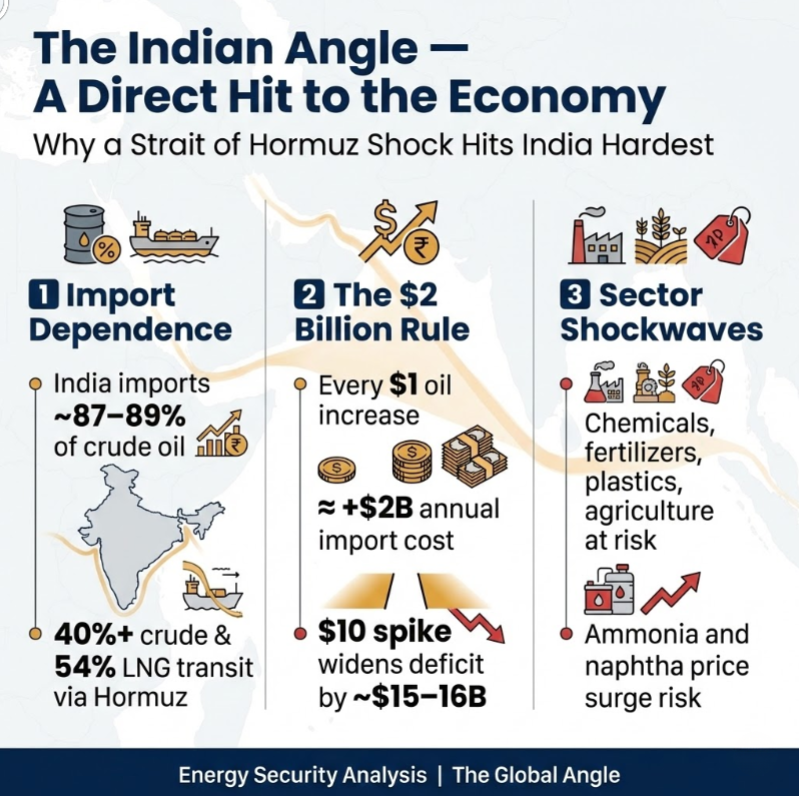

The Indian Angle: A Direct Hit to the Economy

While the US has domestic shale production and a Strategic Petroleum Reserve to cushion the blow, India has no such luxury. India is the world’s third-largest oil consumer, and its economy is acutely vulnerable to Middle Eastern volatility.

Here is the stark reality of India’s exposure:

- The Import Bill Math: India imports a staggering 87% to 89% of its crude oil requirements. Over 40% of this crude, and 54% of its LNG, transits directly through the Strait of Hormuz.

- The “$2 Billion Rule”: For every sustained $1 increase in global crude oil prices, India’s annual import bill balloons by roughly $2 billion. A sudden $10 spike would widen the country’s current account deficit by $15–$16 billion, putting immediate downward pressure on the Rupee and inflating the cost of imported goods.

- The Chemical & Fertilizer Squeeze: The impact goes far beyond the petrol pump. India’s agricultural and manufacturing sectors rely heavily on Gulf imports. A disruption in the Strait would trigger massive price spikes in naphtha (vital for plastics), methanol, and ammonia. Because ammonia is a primary feedstock for fertilizers, a supply shock would force the Indian government to drastically increase its already massive agricultural subsidy budget just to protect farmers.

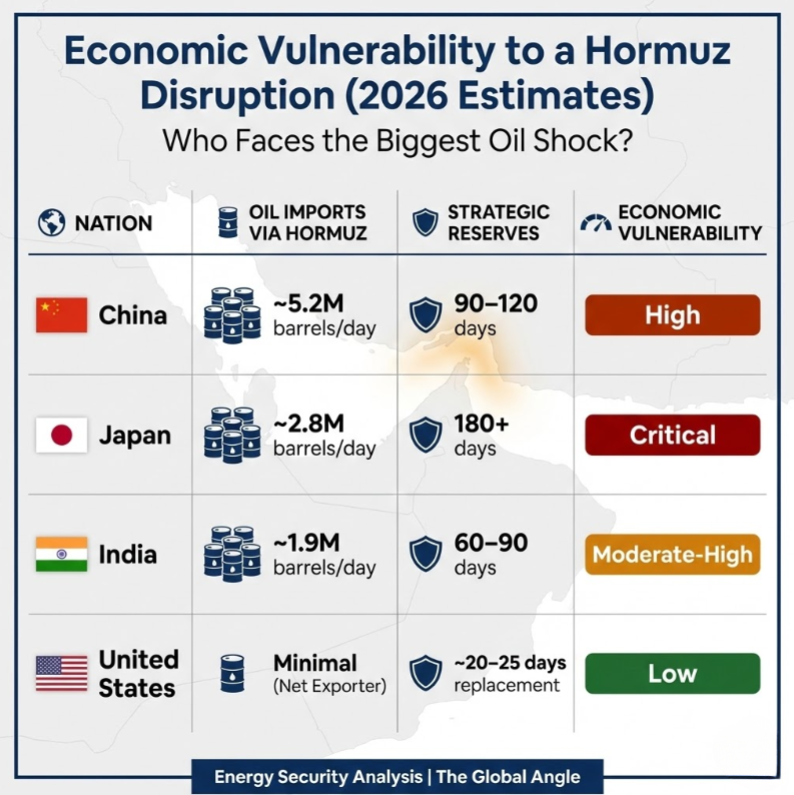

Economic Vulnerability to a Hormuz Disruption (2026 Estimates)

| Nation | Daily Oil Imports via Hormuz | Strategic Reserve Duration | Economic Vulnerability |

| China | ~5.2 million barrels | 90–120 Days | High |

| Japan | ~2.8 million barrels | 180+ Days | Critical |

| India | ~1.9 million barrels | 60–90 Days | Moderate-High (High import dependence, limited buffer) |

| United States | Minimal (Net Exporter) | ~20–25 Days (Import replacement) | Low (Insulated by domestic shale production) |

The New Angle: The “Shadow Fleet” Economics

There is a fascinating, counter-intuitive reason why a complete, prolonged blockade by Iran is actually highly unlikely: The Shadow Fleet.

Due to years of heavy Western sanctions, Iran has developed a highly sophisticated “shadow fleet” of tankers to export its 3.2 million barrels per day (about 4% of global production) to willing buyers, primarily in Asia, at a steep discount.

While oil only makes up about 10% to 15% of Iran’s overall GDP today—thanks to a surprisingly diversified domestic economy—that oil revenue still funds roughly half of the government’s budget. Closing the Strait would effectively mean Iran blockading its own primary source of sovereign income. It is a mutually assured economic destruction tactic.

US Iran conflict oil prices impact Future Outlook: The Next 30 Days

Watch the diplomatic backchannels closely over the next two weeks.

The most likely scenario is not an all-out war, but a prolonged period of elevated “risk premiums.” Traders are pricing in the uncertainty, which means oil will likely hover uncomfortably in the $70–$75 range. If you are an investor, this volatility strengthens the long-term case for domestic energy independence, renewable transitions, and supply-chain resilience—especially for Indian chemical and manufacturing firms highly dependent on Gulf feedstocks.

Final Verdict: The era of isolated geopolitical conflicts is over. Today, a military decision made in Washington regarding a waterway in the Middle East instantly dictates the inflation rate in New Delhi.

Frequently Asked Questions

Why is the Strait of Hormuz so important to oil prices?

The Strait of Hormuz is the only sea passage from the Persian Gulf to the open ocean. Approximately 20 million barrels of oil—20% of global daily consumption—pass through it daily. Any disruption or threat to shipping in this narrow chokepoint instantly causes global energy markets to panic, driving up prices.

How would a US-Iran conflict affect India?

India is highly vulnerable because it imports nearly 88% of its crude oil, with over 40% coming through the Strait of Hormuz. A conflict would spike global oil prices, drastically increasing India’s import bill, weakening the Rupee, and causing inflation in fuel, fertilizers, and everyday goods.

Will gas prices go up in the United States?

Yes. Even though the US produces a massive amount of its own oil, crude is priced on a global market. If an attack restricts Middle Eastern supply, the global price of oil will rise, pushing average US gasoline prices back toward or above $3.00 a gallon.

ALSO READ: Trump new 10% global tariff: Why India’s Tariff Dropped to 10% After Trump’s Supreme Court Defeat

ALSO READ: The 2026 India-EU Free Trade Agreement :”Mother of all deals or A Loophole to enter India”

Delhi on High Alert: Why Delhi is on High Alert Following the Islamabad Blast

Executive Summary Delhi on High Alert The News: As of Saturday, February 21, 2026, New…

US Iran Conflict Oil Prices Impact: How a US-Iran Conflict Could Rewire Global Oil and Hit India 2026

Executive Summary US Iran conflict oil prices impact The News: As President Donald Trump openly…

Trump new 10% global tariff: Why India’s Tariff Dropped to 10% After Trump’s Supreme Court Defeat

Executive Summary Trump new 10% global tariff The News: In a massive 6-3 decision, the…

Google Gemini 3.1 Detailed Review and Comparison: Decoding the Gemini 3.1 Upgrade and the February Outage

Executive Summary Google Gemini 3.1 Review The News: Google has officially rolled out Gemini 3.1…

The 2026 India-EU Free Trade Agreement :”Mother of all deals or A Loophole to enter India”

Executive Summary (The “Global Angle”) The News: On January 27, 2026, after two decades of…

Trump JPMorgan lawsuit 2026: Why JPMorgan is Moving Trump’s Lawsuit to Federal Court

Executive Summary Trump JPMorgan lawsuit 2026 The News: JPMorgan Chase has aggressively pushed back against…