China Trade Surplus 2026 Analysis: How Market Diversification Helped Beijing Offset US Trade Pressure in 2025

China has officially defied the logic of the global trade war. On Wednesday, January 14, 2026, Beijing reported a staggering record China trade surplus 2026 of nearly $1.2 trillion for the previous year. Despite aggressive tariffs from the Trump administration, the world’s second-largest economy has successfully rerouted its “export engine” to new markets, cementing its status as an unshakeable trade superpower.

The Pivot: How China Defied the US Trade War

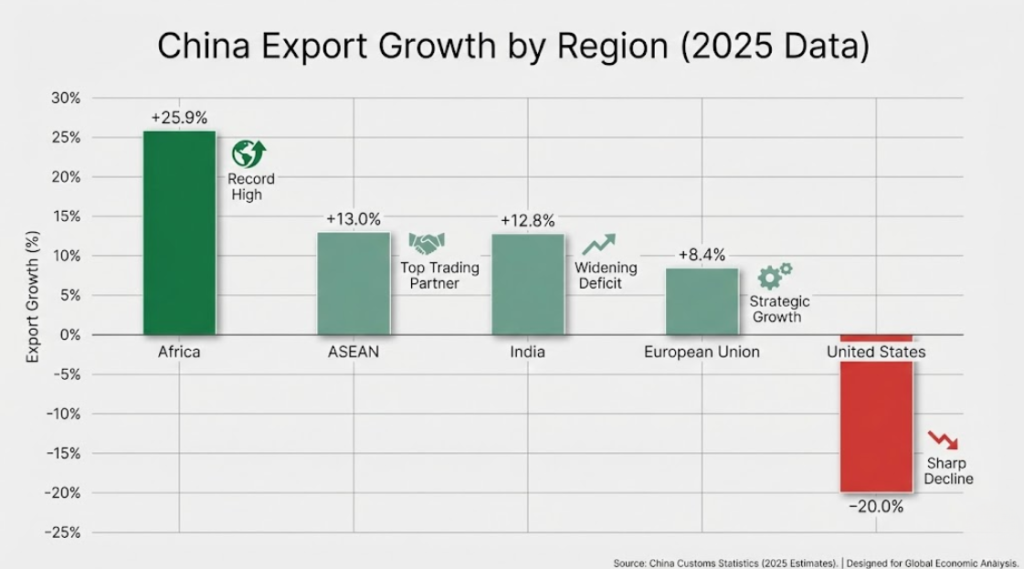

The most surprising element of the China trade surplus 2026 is where the goods are going. While shipments to the United States plummeted by 20% in 2025 due to record-high tariffs, China successfully pivoted its strategy. Manufacturers shifted their focus to the Global South and Europe, essentially “flood-filling” markets that were previously secondary.

Exports to Africa surged by a massive 26%, while the ASEAN bloc became China’s largest trading partner. This diversification proves that while the US can raise walls, the global demand for Chinese-made high-tech goods—including semiconductors, ships, and electric vehicles—continues to grow.

China Export Growth by Region (2025 Data)

| Destination Region | Export Growth (%) | Status in 2026 |

| Africa | +25.9% | Record High |

| ASEAN | +13.0% | Top Trading Partner |

| European Union | +8.4% | Strategic Growth |

| India | +12.8% | Widening Deficit |

| United States | -20.0% | Sharp Decline |

China: The New Trade Superpower?

Experts now argue that China has moved beyond being a “low-cost factory.” The China trade surplus 2026 is driven by high-value mechanical and electrical products, which grew by over 8% last year. Semiconductors and automotive exports were the top performers, showing that China is successfully moving up the value-added ladder.

However, the International Monetary Fund (IMF) has issued a stern warning. IMF Managing Director Kristalina Georgieva noted that China is now “too big” to rely solely on exports. With domestic property markets still in a slump and consumer confidence low, China is essentially “exporting its way out” of internal problems, which risks fueling even more global trade tensions in 2026.

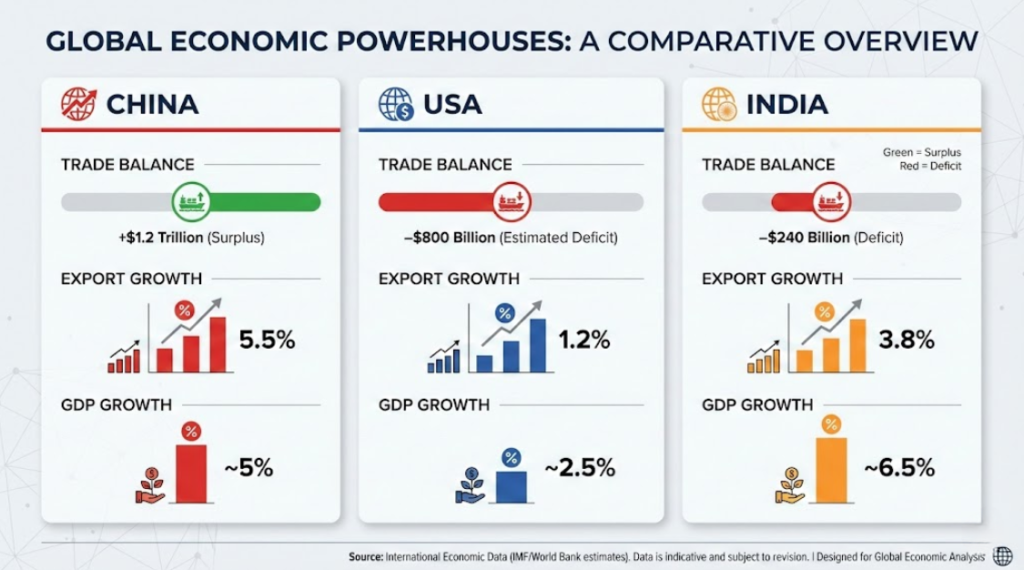

Comparison: China vs. Other Major Economies (2025)

| Metric | China | USA | India |

| Trade Balance | +$1.2 Trillion (Surplus) | -$800 Billion (Estimated Deficit) | -$240 Billion (Deficit) |

| Export Growth | 5.5% | 1.2% | 3.8% |

| GDP Growth | ~5% | ~2.5% | ~6.5% |

What Does This Mean for India?

The China trade surplus 2026 presents a double-edged sword for India. On one hand, Chinese imports to India grew by 12.8% last year, highlighting India’s continued dependence on Chinese electronics, machinery, and pharmaceutical ingredients. This widening bilateral trade deficit is a “strategic vulnerability” for New Delhi.

On the other hand, the global backlash against Chinese “dumping” is creating a “China Plus One” opportunity. As countries in Europe and Southeast Asia seek to reduce their reliance on Beijing, India has a massive chance to scale its own manufacturing through the Production-Linked Incentive (PLI) schemes. However, India must now compete with “dirt-cheap” Chinese inventory that is being redirected away from the US.

Key Takeaway: China’s record surplus is a sign of manufacturing dominance, but it creates a “global glut” that threatens to undercut local industries in emerging markets like India.

Conclusion

The record China trade surplus 2026 confirms that Beijing has won the first phase of the global trade war. By diversifying its partners and dominating high-tech supply chains, China has become a resilient trade superpower. For the world, this means cheaper goods but also a potential for rising protectionism as other nations fight to save their own factories.

Do you think India should impose higher tariffs on Chinese goods to protect its “Make in India” mission?

Is the China trade surplus 2026 sustainable?

Economists warn that without boosting domestic demand, China may face “trade fatigue” as other nations start imposing their own protective tariffs.

Why did exports to the US fall so much?

President Trump’s return to office brought a new wave of 25% to 60% tariffs on almost all Chinese categories, making them uncompetitive in the US.

What are China’s top exports in 2026?

High-tech products, specifically semiconductors (up 26.8%), ships, and electric vehicles, are leading the surge.

Pingback: How Does U.S Midterm Elections Work 5 Massive Facts

Pingback: Analysis: Understanding Taliban Internal Rift and the Connection Between Internet Censorship

Pingback: US Visa Pause - List of all 75 Countries - What are its shocking effects?