Key Takeaways

- The government set a record capital expenditure outlay of ₹12.2 lakh crore to drive infrastructure-led growth.

- Fiscal deficit is targeted at 4.3% of GDP, signaling a continued path of fiscal consolidation.

- Significant shifts in the taxation landscape include the upcoming implementation of the New Tax Act in April 2026.

Finance Minister Nirmala Sitharaman presented the India Union Budget 2026 on February 1, marking her ninth consecutive address and the first to be delivered on a Sunday. Against a backdrop of global economic volatility, the budget prioritizes “Viksit Bharat” (Developed India) through three core pillars: sustaining economic growth, fulfilling citizen aspirations, and ensuring inclusive resource access. The total expenditure for the fiscal year 2026-27 is estimated at ₹53.5 lakh crore, reflecting a 7.7% increase over the previous year’s revised estimates.

This year’s fiscal roadmap is characterized by a “Kartavya” (duty-bound) approach, moving away from short-term populist measures toward long-term structural resilience. The government aims to transform India into a global manufacturing hub while maintaining a delicate balance between aggressive public spending and disciplined deficit management.

Strategic Sectoral Allocations and Fiscal Targets

The cornerstone of the India Union Budget 2026 is the substantial increase in capital expenditure, which now stands at 4.4% of the GDP. This focus on “capex” is designed to crowd in private investment by modernizing the nation’s physical and digital backbone.

The Fiscal Math

The government projects a nominal GDP growth of 10% for the upcoming financial year. To ensure macroeconomic stability, the Finance Minister committed to a fiscal deficit target of 4.3%, down from the 4.4% recorded in the 2025-26 revised estimates. This trajectory is essential for maintaining investor confidence and managing the national debt-to-GDP ratio, which is projected to moderate to 55.6%.

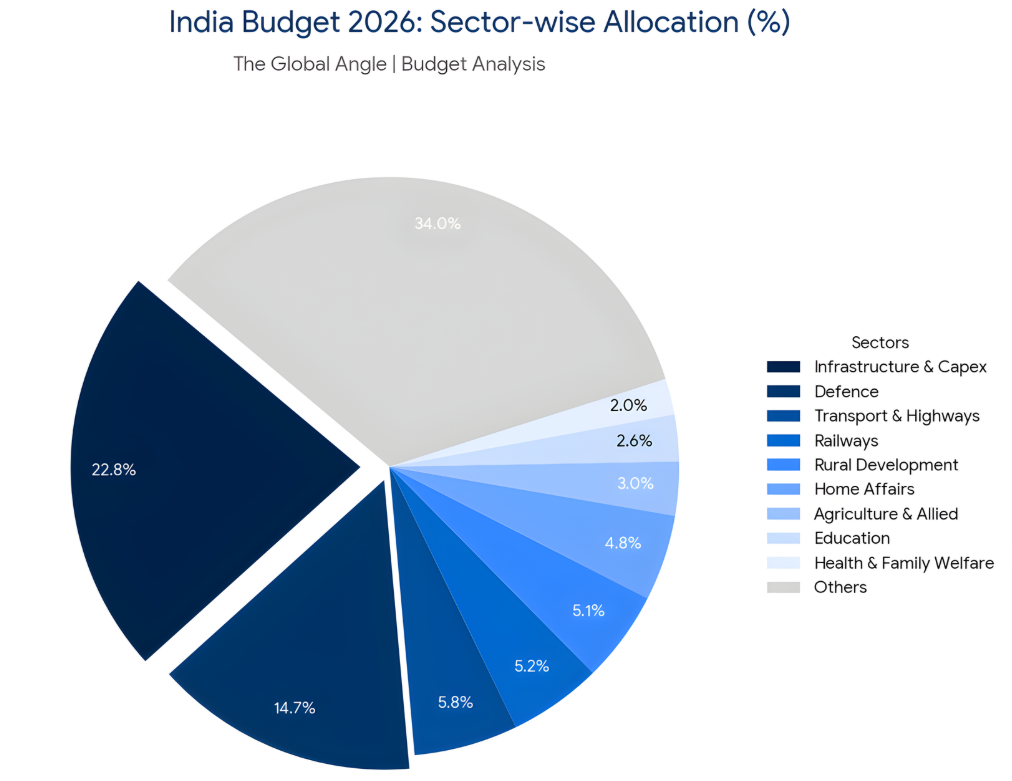

| Sector / Ministry | Allocation (INR Crore) | Approx. % of Total Budget |

| Infrastructure & Capex | 12,20,000 | 22.8% |

| Defence | 7,85,000 | 14.7% |

| Transport & Highways | 3,10,000 | 5.8% |

| Railways | 2,80,000 | 5.2% |

| Rural Development | 2,73,108 | 5.1% |

| Home Affairs | 2,55,234 | 4.8% |

| Agriculture & Allied | 1,62,671 | 3.0% |

| Education | 1,39,289 | 2.6% |

| Health & Family Welfare | 1,05,530 | 2.0% |

Historical Context

Since the 2021-22 fiscal year, the Indian government has followed a specific glide path to reduce the fiscal deficit from pandemic-era highs. The India Union Budget 2026 represents the fulfillment of the pledge to bring the deficit below 4.5% by 2026. This period has also seen a monumental shift from consumption-based spending to asset-creation spending. In 2013-14, the defense budget stood at just ₹2.53 lakh crore; today, at ₹7.85 lakh crore, it has nearly tripled, reflecting India’s evolving security challenges and its “Atmanirbhar Bharat” (Self-Reliant India) initiative.

Analytical Angle: Manufacturing and Technology Hubs

The budget introduces several “frontier” initiatives to reduce import dependency and position India as a leader in high-tech industries. The India Semiconductor Mission (ISM) 2.0 and a ₹40,000 crore outlay for the Electronics Components Manufacturing Scheme are clear indicators of this intent.

By establishing “Rare Earth Corridors” in states like Odisha and Tamil Nadu, the government is securing the supply chain for critical minerals necessary for the green energy transition. Furthermore, the introduction of a tax holiday until 2047 for global data centers aims to capitalize on the AI boom, positioning India as a “hyperscale” destination for global tech giants.

Internal Security and Border Infrastructure

The Ministry of Home Affairs received ₹2.55 lakh crore, a 9% increase, focusing heavily on border infrastructure. The Border Roads Organisation (BRO) saw its capital allocation rise to ₹7,394 crore to expedite strategic tunnels and bridges in high-altitude regions. This spending aligns with the broader geopolitical objective of maintaining a robust deterrent capability along sensitive frontiers.

The Global Perspective & Future Outlook

Over the next five years, the India Union Budget 2026 likely sets the stage for India to become the world’s third-largest economy. The focus on “City Economic Regions” (CERs) suggests a decentralization of growth, moving economic activity into Tier-II and Tier-III cities. This prevents the over-saturation of megacities like Mumbai and Delhi while creating regional growth engines.

Globally, India’s fiscal prudence—targeting a 4.3% deficit while other major economies struggle with rising debt—makes it an attractive destination for Foreign Direct Investment (FDI). However, the success of this budget hinges on execution. Whether the ₹12.2 lakh crore capex can be deployed efficiently without project delays remains the primary challenge for the administration.

The India Union Budget 2026 effectively bridges the gap between social welfare and industrial ambition. While it offers no major immediate relief in personal income tax slabs, it promises a simpler, more predictable regulatory environment through the upcoming New Tax Act. By prioritizing domestic defense production and high-tech manufacturing, the government is betting on a “supply-side” boom to generate employment and sustain growth.

Will the private sector finally take the baton from the government and lead the next wave of capital investment?

Frequently Asked Questions

Does the India Union Budget 2026 change income tax slabs?

No, the Finance Minister did not announce changes to the current income tax slabs. However, the government will implement the New Tax Act starting April 1, 2026, which aims to simplify the entire tax structure.

What is the focus of the new ‘Biopharma SHAKTI’ scheme?

The Biopharma SHAKTI scheme is a ₹10,000 crore initiative over five years intended to establish India as a global hub for biologics and biosimilars, including the creation of 1,000 accredited clinical trial sites.