Introduction

Trump oil price policy Saudi Arabia is the central reason Saudi Aramco finds itself under sustained financial and strategic pressure. Despite being the world’s most powerful oil producer, Saudi Arabia is forced to operate within a narrow oil price range defined by U.S. political and economic priorities.

This policy framework leaves Aramco struggling to balance dividends, state revenue needs, and ambitious national projects, while having little room to challenge Washington’s demands.

Trump’s Core View on Saudi Oil Strategy

During Donald Trump’s first term, the U.S. administration developed a hardened view of Saudi Arabia’s oil behaviour. According to a senior legal figure from that administration, Washington had lost patience with repeated Saudi attempts to influence oil prices in ways that harmed U.S. producers.

That frustration stemmed largely from Saudi Arabia’s use of oil price wars as a strategic tool, particularly during periods of market stress.

The 2020 Oil Price War and U.S. Retaliation Threat

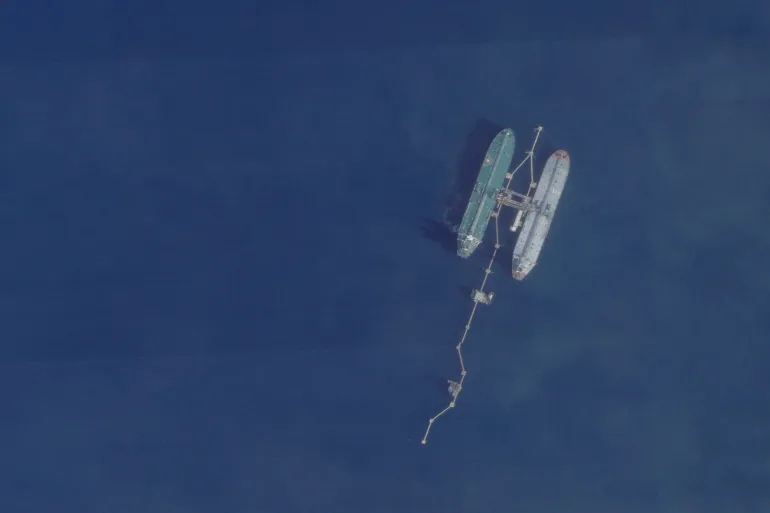

In early 2020, Saudi Arabia sharply increased oil production to drive prices down. The goal was to cripple U.S. shale producers, similar to the strategy used during the 2014–2016 oil price war.

That earlier episode had already damaged Saudi finances without eliminating shale. The 2020 attempt triggered a direct response from Trump.

The Phone Call That Redefined the Relationship

On 2 April 2020, Trump personally called Saudi Crown Prince Mohammed bin Salman. The message was blunt.

If OPEC did not cut production and allow oil prices to rise, Trump said he would be unable to prevent U.S. lawmakers from passing legislation to withdraw American troops from Saudi Arabia.

Trump also warned that any future attempt to repeat such a price war would end the 1945 U.S.–Saudi agreement that formed the basis of their long-standing cooperation.

Saudi Arabia and OPEC cut production soon after.

What Trump Oil Price Policy Saudi Arabia Actually Means

A Strictly Enforced Price Range

The Trump oil price policy Saudi Arabia revolves around maintaining a tightly controlled oil price band.

The lower bound protects U.S. shale producers. Well-established shale sites can break even at around US$35 per barrel of WTI. Historically, this corresponds to about US$40 per barrel of Brent crude.

The upper bound is equally critical. It sits near US$70 per barrel of WTI, or roughly US$75 per barrel of Brent. Prices above this level risk pushing U.S. gasoline prices higher.

Saudi Arabia is expected to respect both limits.

Why the Upper Price Limit Matters in the U.S.

Oil prices have a direct relationship with U.S. gasoline prices and consumer spending.

According to historical data cited in the source, every US$10 per barrel change in crude oil prices leads to a 25–30 cent change in the price of gasoline.

For every 1 cent increase in gasoline prices, more than US$1 billion per year is lost in consumer spending.

This makes high oil prices politically dangerous for any U.S. president.

Oil Prices and U.S. Electoral Politics

The Trump oil price policy Saudi Arabia is also shaped by electoral logic.

Since 1896, sitting U.S. presidents have won re-election 11 out of 11 times when the economy was not in recession within two years of an election. When presidents entered re-election campaigns during a recession, they won only once out of seven.

Allowing oil prices to surge would increase inflation risks and threaten economic stability.

Saudi Arabia’s Fiscal Breakeven Problem

Saudi Arabia’s fiscal breakeven oil price currently stands at approximately US$90.9 per barrel of Brent crude.

That level is far above the upper ceiling enforced under Trump’s oil price policy. With Brent prices hovering around US$70 per barrel, Saudi Arabia faces a persistent budget shortfall.

Aramco absorbs much of this strain as the Kingdom’s main revenue source.

How the Policy Is Hurting Saudi Aramco

Dividend Cuts and Falling Profits

Aramco reported a 5% year-on-year drop in profit for the first quarter. As a result, it sharply reduced its quarterly dividend.

The company also announced that full-year dividends are expected to fall to US$85.4 billion, down from US$124.3 billion in 2024.

For a company whose IPO relied heavily on dividend promises, this has damaged market confidence.

Why Aramco’s Financing Options Are Risky

Increased Reliance on Debt

One response has been to issue bonds. Aramco sold US$5 billion in bonds in May and has signalled that further borrowing may follow.

This increases Saudi Arabia’s debt burden and gives bondholders greater influence over Aramco’s decisions. According to the source, many such bondholders are likely linked to U.S. financial interests.

Selling Assets as an Alternative

Another option under discussion is selling key power assets and pipelines.

Officially, the proceeds are meant to fund Vision 2030, Saudi Arabia’s plan to reduce dependence on oil. However, investor concerns persist about whether funds will support productive reform or high-profile prestige projects.

Growing Doubts Around Vision 2030 and Neom

Vision 2030 has faced increasing skepticism.

The Neom City project has already been scaled down dramatically. Its planned length by 2030 has been reduced from 170 kilometres to just 2.4 kilometres.

At the same time, attention appears to be shifting toward large global events such as the FIFA World Cup 2034.

These factors make investors cautious about Aramco’s long-term financial discipline.

Trump’s Legal Leverage Over Saudi Arabia

The NOPEC Bill as a Strategic Threat

Beyond military pressure, Trump retains a powerful legal tool: the No Oil Producing and Exporting Cartels (NOPEC) Bill.

The bill has reportedly been prepared for rapid passage. If enacted, it would make it illegal for OPEC to cap production or set prices and would remove sovereign immunity for member states in U.S. courts.

What NOPEC Could Mean for Aramco

Under NOPEC, Saudi Arabia could face lawsuits under U.S. anti-trust laws tied to its estimated US$1 trillion in U.S. investments.

The U.S. could freeze Saudi bank accounts, seize assets, halt dollar transactions, and target Aramco directly as a state-owned entity.

Aramco could even be forced to break into smaller companies to comply with competition rules.

Why Saudi Arabia Has Little Room to Push Back

Trump oil price policy Saudi Arabia leaves Riyadh with few viable options.

Raising oil prices risks severe U.S. retaliation. Borrowing increases debt and foreign influence. Asset sales undermine long-term capacity and investor confidence.

The policy effectively transfers adjustment costs to Saudi Arabia while protecting U.S. economic interests.

Conclusion

Trump oil price policy Saudi Arabia explains why Saudi Aramco cannot escape financial pressure despite its global dominance. The United States controls the acceptable oil price range using political, legal, and military leverage.

Saudi Arabia’s fiscal needs sit well above that range. Aramco is forced to cut dividends, borrow more, or sell assets, all while facing growing skepticism about long-term strategy.

The deeper issue is not whether Aramco can endure this pressure, but how long Saudi Arabia can sustain an economic model constrained by external price control.

Frequently Asked Questions

1. What is Trump oil price policy Saudi Arabia?

It is a U.S. strategy that enforces a narrow oil price range to protect American economic growth and shale producers, regardless of Saudi fiscal needs.

2. Why does this policy hurt Saudi Aramco?

Saudi Arabia’s budget requires much higher oil prices than the enforced ceiling, forcing Aramco to absorb financial losses.

3. How has Aramco responded so far?

Aramco has cut dividends, issued bonds, and explored selling assets to manage revenue shortfalls.

4. What role does the NOPEC Bill play?

The NOPEC Bill acts as a legal threat that could expose Saudi Arabia and Aramco to lawsuits, asset seizures, and financial sanctions.

Also Read:- US war with Venezuela – 7 Shocking Ways the US Is Already at War With Venezuela

Also Read:- Strategic BJP Shift: Pankaj Chaudhary UP BJP President Role Explained in 7 Points