Aadhaar PAN Linking Deadline 2025: A Last-Minute Guide for Taxpayers

Introduction

Aadhaar PAN linking deadline 2025 is fast approaching, with taxpayers required to complete the process by 31 December 2025 to keep their PAN valid. The Income Tax Department has made it clear that failure to link Aadhaar with PAN will render the PAN inoperative.

With only days left, many taxpayers are still unsure about eligibility, consequences, and the exact steps involved. This guide explains what Aadhaar-PAN linking means, why it matters, and how to complete it before the deadline.

What Is Aadhaar-PAN Linking

Aadhaar-PAN linking is the process of connecting an individual’s Permanent Account Number with their Aadhaar number.

The objective is to verify identity, eliminate duplicate PANs, and strengthen the integrity of India’s tax system. Once linked, the PAN remains active and usable for all financial and tax-related purposes.

For new PAN applicants, this linking is completed automatically during the application process.

Who Must Link Aadhaar With PAN

According to a notification issued by the Income Tax Department on 3 April 2025, Aadhaar-PAN linking is mandatory for individuals whose PAN was issued using an Aadhaar number before 1 October 2024.

Any individual who holds a PAN and is eligible for an Aadhaar number must complete this process by the Aadhaar PAN linking deadline 2025.

The requirement applies regardless of income level or tax filing status.

Why Aadhaar-PAN Linking Is Mandatory

Section 139AA of the Income Tax Act makes Aadhaar-PAN linking compulsory.

The Income Tax Department has clearly stated that PANs not linked with Aadhaar by the deadline will become inoperative. An inoperative PAN cannot be used for filing income tax returns, financial transactions, or other official purposes.

This makes Aadhaar-PAN linking essential even for those who are not currently filing tax returns.

Consequences of Missing the Deadline

Failing to meet the Aadhaar PAN linking deadline 2025 can have serious implications.

An inoperative PAN may prevent taxpayers from:

- Filing income tax returns

- Completing high-value financial transactions

- Opening bank or investment accounts

- Complying with statutory requirements

The Income Tax Department has warned that PAN validity depends on timely Aadhaar linking.

Who Can Use the Online Linking Service

The Link Aadhaar service is available to individual taxpayers, whether or not they are registered on the Income Tax e-Filing portal.

Taxpayers can complete the process either directly from the portal homepage or after logging into their account.

The process is entirely online and does not require physical submission of documents.

Prerequisites for Aadhaar-PAN Linking

Before starting the process, taxpayers must keep the following ready:

- Valid PAN

- Aadhaar number

- Valid mobile number for OTP verification

Ensuring that Aadhaar and PAN details match will help avoid delays.

How to Link Aadhaar With PAN: Step-by-Step Guide

Follow these steps carefully to complete Aadhaar-PAN linking online.

Step 1

Visit the Income Tax e-Filing Portal and select Link Aadhaar from the Quick Links section.

Alternatively, log in and access Link Aadhaar under the Profile section.

Step 2

Enter your PAN and Aadhaar number.

Step 3

Click Continue to proceed to the e-Pay Tax option.

Step 4

Enter your PAN again, confirm it, and provide a mobile number to receive an OTP.

Step 5

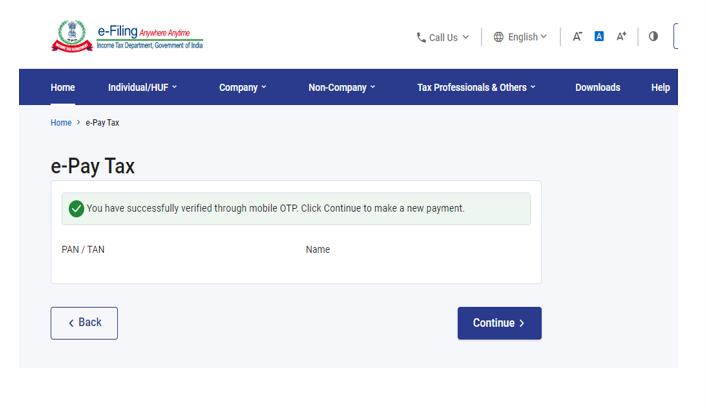

Verify the OTP sent to your mobile number.

Step 6

You will be redirected to the e-Pay Tax page. Click Proceed.

Step 7

Select the relevant Assessment Year and choose Type of Payment as Other Receipts. Click Continue.

Step 8

The applicable amount will be auto-filled under Others. Click Continue.

Step 9

Log in again to the e-Filing Portal. On the Dashboard, go to the Profile section and click Link Aadhaar to PAN.

Step 10

Enter your Aadhaar number and click Validate to complete the process.

Common Mistakes to Avoid

Many last-minute applicants face issues due to small errors.

Ensure that:

- Name and date of birth match in Aadhaar and PAN records

- The mobile number linked to Aadhaar is active

- Details are entered carefully without spelling errors

Correcting mismatches beforehand can save time.

Why Acting Now Is Important

As the Aadhaar PAN linking deadline 2025 approaches, portal traffic is expected to increase.

Delaying the process increases the risk of technical issues or incomplete submissions. Completing the linking early ensures uninterrupted access to PAN-related services.

The Income Tax Department has urged taxpayers to verify and update their details within the stipulated period.

Conclusion

Aadhaar PAN linking deadline 2025 is not just a procedural formality. It directly affects the validity of your PAN and your ability to carry out essential financial and tax activities.

With the deadline set for 31 December 2025, taxpayers should act promptly to avoid complications. Completing the process now ensures compliance, continuity, and peace of mind.

Have you checked whether your PAN is already linked with Aadhaar?

Frequently Asked Questions

Is Aadhaar-PAN linking mandatory for everyone?

Yes, for all individuals who hold a PAN and are eligible for Aadhaar.

What happens if PAN is not linked by December 31, 2025?

The PAN will become inoperative.

Can Aadhaar-PAN linking be done without logging in?

Yes, the service is available to both registered and unregistered users.

Is linking required for new PAN applicants?

No, Aadhaar-PAN linking is completed automatically during new PAN applications.

ALSO READ: Dr. Manmohan Singh Key Contributions Remembered on First Death Anniversary

ALSO READ: Kerala SIR 2026 Voter List Released: How to Check Your Name

Pingback: Important Update: Get PM Kisan Yojana 22nd Installment in 3 Steps