Billion Market Slide:

Key Takeaways

- Historic Amazon $450 billion market value loss 2026: Amazon recently faced its longest streak of daily losses since 2006, wiping out roughly $463 billion in market valuation over 10 days.

- The AI Spending Scare: The crash was triggered by an aggressive plan to invest $200 billion in AI infrastructure in 2026, fueling investor fears over short-term cash flow.

- The Bezos Wisdom: As the stock dipped, a viral 2000 shareholder letter from Jeff Bezos resurfaced, reminding investors to distinguish between a “voting machine” (market noise) and a “weighing machine” (long-term value).

In the first two weeks of February 2026, Amazon investors experienced a sense of vertigo. After the company announced a massive capital expenditure (capex) plan, the stock plummeted 18%, marking its worst run in almost two decades. As billions in market cap evaporated, an old letter from the company’s founder, Jeff Bezos, began circulating on social media, offering a stoic perspective on market volatility that feels as relevant today as it did during the dot-com bubble.

Why Did Amazon Lose $450 Billion in 10 Days?

The sudden sell-off wasn’t due to a lack of growth; in fact, Amazon’s revenue and operating income remain strong. The decline was fueled by a “spending shock.”

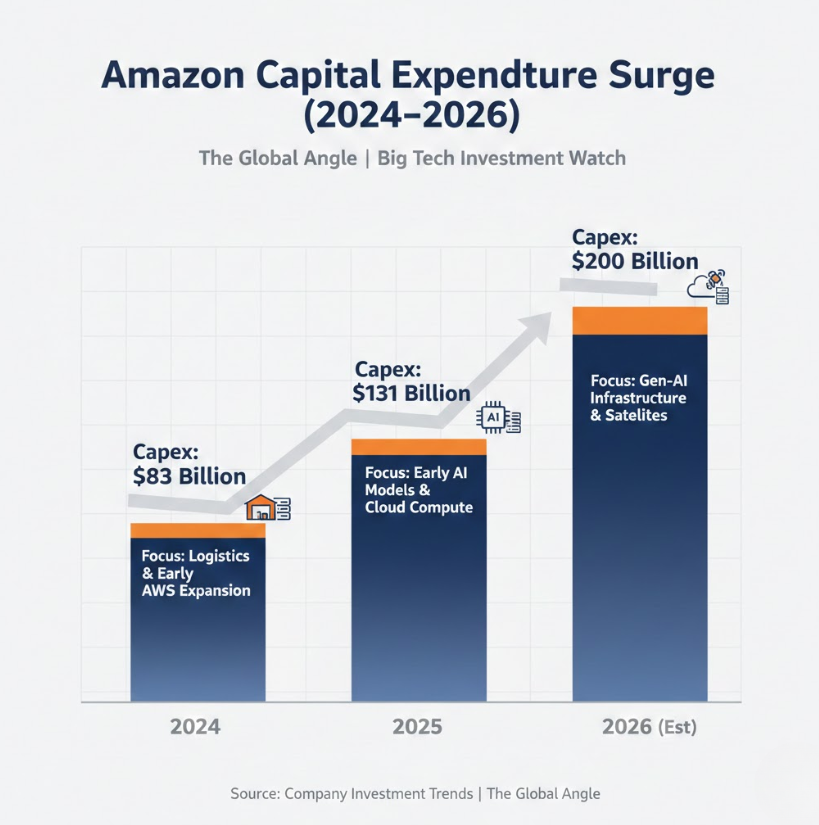

The $200 Billion AI Bet

On February 5, 2026, CEO Andy Jassy revealed that Amazon expects to spend roughly $200 billion this year on data centers, custom chips, and robotics to dominate the generative AI landscape. While Jassy framed this as a “seminal opportunity,” Wall Street saw a “red flag.”

- Negative Free Cash Flow: Investors are concerned that this level of spending—exceeding Amazon’s 2025 operating cash flow of $140 billion—will lead to negative free cash flow in the short term.

- The “Magnificent Seven” Bear Market: Amazon followed Microsoft into a technical bear market as investors scrutinized whether massive AI investments will yield profits quickly enough.

| Year | Capital Expenditure (USD) | Primary Strategic Focus |

| 2024 | $83 Billion | Logistics & Early AWS Expansion |

| 2025 | $131 Billion | Early AI Models & Cloud Compute |

| 2026 (Est) | $200 Billion | Gen-AI Infrastructure & Satellites |

The “Ouch” Letter: Jeff Bezos’ Advice from 2000

As the stock dipped toward $198, an annual letter written by Jeff Bezos in 2000 resurfaced on X (formerly Twitter). At that time, Amazon’s stock had fallen a staggering 80% during the dot-com crash.

Bezos opened the letter with a single, blunt word: “Ouch.”

However, he immediately pivoted to a core philosophy that has defined Amazon for 30 years. He pointed out that while the stock price was “down 80%,” the company itself was “better positioned than it was a year ago.”

Voting vs. Weighing

Citing the legendary investor Benjamin Graham, Bezos wrote:

“In the short term, the stock market is a voting machine; in the long term, it’s a weighing machine.”

Bezos argued that the 1999 “boom year” was full of “voting” (hype and speculation), whereas the 2000 crash was a moment for “weighing” (analyzing actual performance). He emphasized that Amazon was focused on building a “heavier and heavier company” by obsessing over customers rather than stock charts.

The 2000 Metrics vs. 2026

In 2000, Bezos highlighted that sales had grown to $2.76 billion and customer satisfaction was at an all-time high (84 on the ACSI). Today, Andy Jassy is using a similar narrative, asking for patience as the company builds the “heavier” infrastructure required for the AI era, much like Bezos did for AWS in 2006.

The Global Perspective & Future Outlook

History suggests that Amazon’s periods of massive spending often lead to era-defining dominance. When Amazon launched AWS in 2006, the stock also suffered a nine-day losing streak as critics called the project a “waste of money.” Today, AWS is a $140+ billion revenue engine.

If Amazon’s $200 billion AI bet mirrors the AWS trajectory, the current $450 billion loss may eventually be seen as a “buying opportunity” for patient investors. However, with U.S. tariffs starting to impact consumer pricing and competitive pressure from rivals like Google and Meta (who are also spending billions), the “weighing” of Amazon’s AI era may take several years to finalize.

Is the market currently “voting” out of fear, or is it accurately “weighing” the risks of over-investment?

Frequently Asked Questions

Why did Jeff Bezos write “Ouch” in his 2000 letter?

He was acknowledging the brutal reality that Amazon’s share price had dropped more than 80% in a single year during the dot-com bubble, despite the company’s internal fundamentals improving.

What is the ‘Magnificent Seven’ in the stock market?

The “Magnificent Seven” refers to the top U.S. tech giants: Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta, and Tesla. In early 2026, they collectively lost nearly $1 trillion in value as investors soured on heavy AI spending.

What is Amazon’s longest losing streak other than Amazon $450 billion market value loss 2026?

Amazon’s longest losing streak is nine days. This occurred in July 2006 and was matched in February 2026. Both instances followed the announcement of massive capital investment plans (AWS in 2006 and AI in 2026).

ALSO READ: US Trade 2026: The Complete Economic Breakdown

ALSO READ: Did India Stop Buying Russian Oil? The Economic Reality

The End of “Free Leverage”: How RBI’s 2026 Guidelines Are Reshaping the Broking Industry

Executive Summary (The “Global Angle”) The News: The Reserve Bank of India (RBI) has issued…

The Thermal Masterstroke: Why the 2026 F1 Championship Could Be Decided in Court

F1 vs Mercedes key takeaways – The News: The FIA has launched an emergency e-vote…

Winter Olympics 2026 “A New Era”: How Milano Cortina Rewrote the Olympic Playbook

Winter Olympics 2026 key notes – The News: As the Milano Cortina 2026 Winter Games…

Andrew Mountbatten-Windsor arrest 2026: Why This Redefines Royal Immunity

Executive Summary Andrew Mountbatten-Windsor arrest 2026 The News: On his 66th birthday (February 19, 2026),…

Yoon Suk Yeol life sentence: The Dec 2024 Insurrection & The “Pardon Cycle”

Executive Summary Yoon Suk Yeol life sentence The News: A Seoul court has sentenced former…

India AI Impact Summit Day 2 Summary: The Day the “AI Hype” Broke the Doors Down

Executive Summary India AI Impact Summit Day 2 Summary The News: Day 2 of the…