Key Takeaways

- China Trade Surplus 2026 Breakdown

- China’s trade surplus hit a record $1.19 trillion in 2025, driven by a strategic pivot to the Global South.

- ASEAN has solidified its spot as China’s largest trading partner, surpassing the EU and USA.

- The “New Three” sectors (EVs, Batteries, Solar) saw a combined export growth of 27.1%, offsetting declines in traditional manufacturing.

- Despite tariffs, the trade surplus with the United States remains massive at over $340 billion, though direct shipments have fallen.

The release of the official China Trade Surplus 2026 breakdown reveals a historic decoupling and recoupling of the global economy. Closing the year with a surplus of nearly $1.2 trillion, Beijing has effectively managed to keep its export engine roaring by substituting Western demand with surging orders from Southeast Asia, Africa, and Russia.

Below is a detailed data breakdown of who is buying, what they are buying, and where the money is flowing.

1. Country-Wise Trade Balance: The Winners and Losers

The geography of China’s surplus has shifted. While the surplus with the U.S. remains the largest in absolute terms, the growth is now coming from the developing world.

Top Trade Surplus Partners (2025-26 Data)

| Rank | Trading Partner | Exports (Approx. $B) | Imports (Approx. $B) | Trade Balance (Surplus) | Trend vs. 2024 |

| 1 | United States | $524.7 | $163.6 | **+$361.1 Billion** | 🔻 Decline (Direct) |

| 2 | European Union | $516.5 | $269.3 | **+$247.2 Billion** | 🟢 Stable |

| 3 | ASEAN (Bloc) | $586.5 | $395.8 | **+$190.7 Billion** | 🚀 Rapid Growth |

| 4 | India | $117.7 | $20.5 | **+$97.2 Billion** | 📈 Increasing |

| 5 | Vietnam* | $161.9 | $98.8 | **+$63.1 Billion** | 🚀 Surge (Re-export Hub) |

> Note: Vietnam’s surplus is partially attributed to the “Great Reallocation,” where Chinese components are assembled in Vietnam to bypass Western tariffs.

Top Trade Deficit Partners (Where China Buys From)

China runs deficits primarily with countries that supply raw materials (energy, ore) and high-end technology (chips).

| Rank | Trading Partner | Key Imports | Trade Balance (Deficit) |

| 1 | Taiwan | Advanced Semiconductors | -$142.6 Billion |

| 2 | Australia | Iron Ore, LNG, Coal | -$84.7 Billion |

| 3 | Brazil | Soybeans, Crude Oil, Iron | -$50.3 Billion |

| 4 | South Korea | Electronics, Petrochemicals | -$35.3 Billion |

| 5 | Russia | Oil, Gas, Coal | -$13.8 Billion |

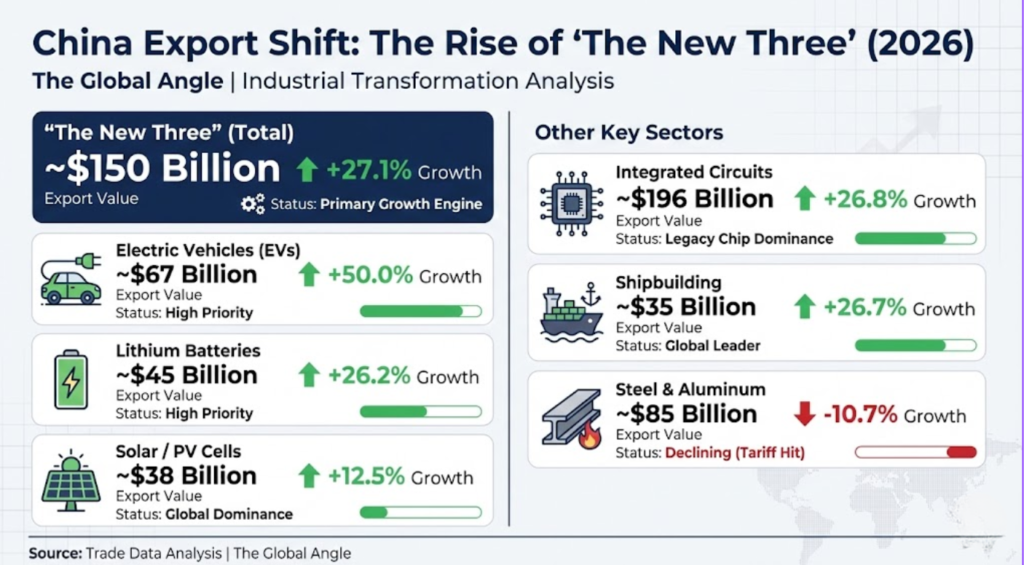

2. Sector Wise China Trade Surplus 2026 Breakdown: The Rise of “The New Three”

The most significant story of 2026 is the industrial upgrade. Low-cost manufacturing (clothing, furniture) is shrinking as a share of total value, replaced by high-tech green energy goods.

Export Growth by Sector (YoY %)

| Industry / Sector | 2025 Export Value | YoY Growth | Strategic Status |

| “New Three” (Total) | **~$150 Billion** | +27.1% | Primary Growth Engine |

| — Electric Vehicles (EVs) | ~$67 Billion | +50.0% | High Priority |

| — Lithium Batteries | ~$45 Billion | +26.2% | High Priority |

| — Solar/PV Cells | ~$38 Billion | +12.5% | Global Dominance |

| Integrated Circuits | ~$196 Billion | +26.8% | Legacy Chip Dominance |

| Shipbuilding | ~$35 Billion | +26.7% | Global Leader |

| Steel & Aluminum | ~$85 Billion | -10.7% | Declining (Tariff Hit) |

3. The Digital Surplus: A Hidden Boom

Often overlooked in goods trade is the booming Digital Services sector.

- Digital Trade Surplus: reached $33 Billion (Doubled from previous year).

- Key Drivers: Cloud computing services, AI software exports, and telecom operations.

- Significance: This helps offset China’s traditional deficit in services (usually caused by tourism).

4. Regional Pivot: The “Global South” Strategy

With the U.S. imposing tariffs of up to 60% on certain goods, China has successfully pivoted.

- Exports to Africa: Surged by 18.4%, driven by heavy machinery and infrastructure projects.

- Exports to Latin America: Grew by 6.5%, deepening ties in industrial equipment and 5G infrastructure.

- The Russia Factor: Bilateral trade with Russia reached a record $244.8 Billion, with China supplying cars and consumer electronics in exchange for discounted energy.

The Future Outlook: Can the Surplus Last?

The $1.2 trillion surplus is a double-edged sword. While it proves Chinese manufacturing resilience, it invites retaliatory tariffs from not just the U.S., but potentially the EU and India, who are wary of their own widening deficits. The 2026 forecast suggests a slight moderation as “friend-shoring” policies in the West take firmer root, but China’s dominance in the inputs of the future economy (batteries, green tech) ensures it will remain central to global trade.

Frequently Asked Questions

What is China’s total trade surplus for 2026?

Official data for the full calendar year 2025 (released in early 2026) confirms a record surplus of $1.19 Trillion.

Which country has the largest trade deficit with China?

The United States continues to have the largest bilateral trade deficit with China, estimated at over $360 billion, despite ongoing tariff wars.

What are “The New Three” in Chinese exports?

This term refers to Electric Vehicles (NEVs), Lithium-ion Batteries, and Solar products. These three sectors have replaced traditional cheap manufacturing as the main drivers of China’s export growth.

Why is China’s trade with Vietnam increasing so fast?

Vietnam has become a key “connector” economy. Chinese firms export components to Vietnam for final assembly to avoid direct “Made in China” tariffs when selling to Western markets.

ALSO READ: India’s Energy Security 2026: The $190 Billion Import Landscape

ALSO READ: Russian vs Venezuelan Crude Oil: Comparing Oil Quality and Prices for India

The End of “Free Leverage”: How RBI’s 2026 Guidelines Are Reshaping the Broking Industry

Executive Summary (The “Global Angle”) The News: The Reserve Bank of India (RBI) has issued…

The Thermal Masterstroke: Why the 2026 F1 Championship Could Be Decided in Court

F1 vs Mercedes key takeaways – The News: The FIA has launched an emergency e-vote…

Winter Olympics 2026 “A New Era”: How Milano Cortina Rewrote the Olympic Playbook

Winter Olympics 2026 key notes – The News: As the Milano Cortina 2026 Winter Games…

Andrew Mountbatten-Windsor arrest 2026: Why This Redefines Royal Immunity

Executive Summary Andrew Mountbatten-Windsor arrest 2026 The News: On his 66th birthday (February 19, 2026),…

Yoon Suk Yeol life sentence: The Dec 2024 Insurrection & The “Pardon Cycle”

Executive Summary Yoon Suk Yeol life sentence The News: A Seoul court has sentenced former…

India AI Impact Summit Day 2 Summary: The Day the “AI Hype” Broke the Doors Down

Executive Summary India AI Impact Summit Day 2 Summary The News: Day 2 of the…