Elon Musk Net Worth 700 Billion and the Power of Corporate Control

Elon Musk net worth 700 billion became a reality this week after a decisive legal ruling reshaped the balance between executive power and shareholder authority. On December 20, Musk’s personal wealth surged to an estimated $749 billion following a decision by the Delaware Supreme Court to reinstate his long-disputed Tesla stock options.

The moment matters because this was not driven by a market rally alone. It was the result of a court restoring a compensation structure that had previously been invalidated. The ruling has implications not only for Musk, but also for how corporate governance, executive pay, and shareholder consent are interpreted in the United States.

What the Court Decided

The Delaware Supreme Court ruled that a 2024 decision which rescinded Musk’s Tesla pay package had been improper and inequitable. That earlier ruling had voided the compensation deal, calling it excessive.

By reversing that decision, the court restored Tesla stock options currently valued at $139 billion. The original pay package dates back to 2018 and was once valued at $56 billion, before Tesla’s valuation surge dramatically increased its worth.

This legal reversal directly triggered the jump in Musk’s net worth.

How Elon Musk Net Worth 700 Billion Was Reached

Musk’s wealth increase was swift and concentrated. According to Forbes’ billionaires index, his net worth climbed to $749 billion following the ruling.

Key Financial Figures Referenced

| Item | Amount |

|---|---|

| Musk net worth after ruling | $749 billion |

| Restored Tesla stock options | $139 billion |

| Original 2018 pay package value | $56 billion |

| Shareholder-approved pay plan | $1 trillion |

These numbers underline how compensation structures tied to equity can amplify personal wealth at unprecedented scale.

The Role of Tesla Shareholders

A critical element behind Elon Musk net worth 700 billion is shareholder approval. In November, Tesla shareholders voted to approve a $1 trillion compensation plan for Musk.

This vote was not merely symbolic. It reinforced investor confidence in Musk’s leadership and his long-term vision for Tesla. Shareholders effectively endorsed a governance model where outsized rewards are justified by transformational ambition.

The court’s decision aligned legal interpretation with shareholder intent.

Why This Ruling Matters Beyond Musk

The ruling carries significance beyond one individual. It clarifies how courts may view executive compensation when shareholders explicitly approve it.

By calling the earlier rescission inequitable, the Supreme Court signaled limits to judicial intervention in shareholder-backed decisions. This could influence how future disputes over executive pay are handled, especially in companies led by dominant founders.

For corporate boards, the message is clear. Shareholder consent carries substantial legal weight.

Comparison With Other Billionaires

Elon Musk net worth 700 billion has created an unprecedented gap at the top of global wealth rankings. Musk’s fortune now exceeds that of Google co-founder Larry Page, the world’s second-richest person, by nearly $500 billion.

This scale of disparity highlights how founder-led companies with equity-heavy compensation structures can generate wealth far beyond traditional executive models.

It also raises questions about concentration of economic influence in a small number of individuals.

The SpaceX Factor

Earlier in the week, Musk became the first person to surpass $600 billion in net worth. That milestone followed reports suggesting his aerospace company SpaceX was likely to go public.

While Tesla remains central to Musk’s wealth, the anticipation surrounding SpaceX has amplified investor perception of his broader business empire. Even without new transactions, expectations alone have played a role in valuation momentum.

This illustrates how narrative and future potential can influence present wealth calculations.

Why This Matters Now

Elon Musk net worth 700 billion comes at a moment when executive pay and inequality are under intense global scrutiny. The scale of Musk’s compensation forces a renewed debate on the limits of incentive-based pay.

At the same time, the case reinforces the power of markets and shareholders over regulatory or judicial restraint. In Musk’s case, institutional investors chose vision over moderation.

For policymakers and investors alike, the ruling raises difficult questions about balance.

Corporate Governance Under the Spotlight

Tesla’s case shows how governance frameworks adapt when a company’s identity is closely tied to its founder. Musk’s influence extends across leadership, strategy, and investor sentiment.

The Supreme Court ruling suggests that courts may be reluctant to override shareholder-backed arrangements, even when compensation appears extreme by conventional standards.

This sets a precedent that could embolden other high-profile executives to pursue similar structures.

What Comes Next

There is no indication that Musk intends to alter his compensation structure following the ruling. With shareholder approval already secured, the legal uncertainty surrounding his pay has largely been removed.

Attention may now shift to how Tesla delivers on the ambitious vision shareholders endorsed. Performance expectations will inevitably rise alongside compensation.

For Musk, the ruling consolidates not just wealth, but authority.

Bigger Implications for Capitalism

Elon Musk net worth 700 billion is not just a personal milestone. It reflects how modern capitalism rewards scale, narrative, and concentrated ownership.

As companies increasingly position themselves as platforms for future technologies, compensation models may follow similar trajectories. Whether this remains sustainable or socially acceptable is an open question.

The ruling does not end the debate. It sharpens it.

Conclusion

Elon Musk’s ascent to a $700 billion-plus net worth was not accidental or purely market-driven. It was the product of legal interpretation, shareholder endorsement, and a governance model built around exceptional risk and reward.

The broader question is not whether Musk deserves the wealth, but whether the system that produced it can withstand growing scrutiny.

As corporate power and personal wealth continue to converge, where should the line be drawn?

Frequently Asked Questions

How did Elon Musk net worth 700 billion happen?

It followed a court ruling that restored Tesla stock options worth $139 billion.

What did the Delaware Supreme Court decide?

The court ruled that rescinding Musk’s pay package had been improper and inequitable.

Did Tesla shareholders approve Musk’s pay?

Yes. Shareholders approved a $1 trillion compensation plan in November.

Who is the second-richest person after Musk?

According to Forbes, Google co-founder Larry Page is the world’s second-richest person.

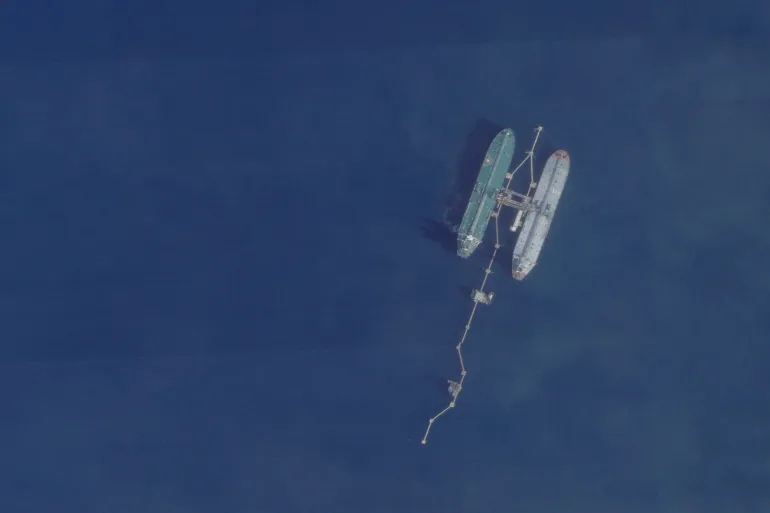

ALSO READ: US Blockade Venezuela Oil and the Shift From Sanctions to Seizures

ALSO READ: New Epstein Photos Released: What 70 Images Reveal Now