Impact Venezuela Tanker Seizures on Oil Prices and Global Energy Markets

Introduction

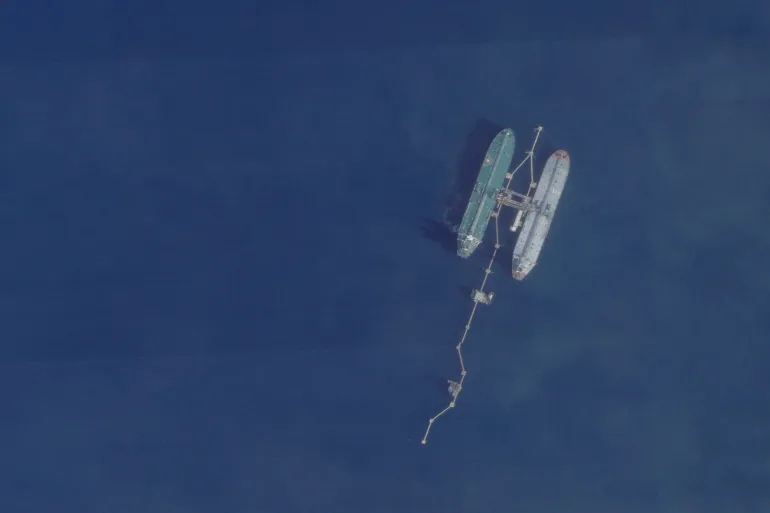

The impact Venezuela tanker seizures on oil prices has become a live issue for global markets, as the United States stepped up enforcement against Venezuelan crude shipments. After multiple seizures and active pursuits of sanctioned vessels near Venezuela’s coast, markets have shown a modest but noticeable response in oil pricing and trading behaviour.

This development matters because Venezuela, while not a dominant crude supplier globally, plays a distinct role in certain supply chains. Disruptions in its shipments, especially under active enforcement regimes, can ripple into broader market psychology and influence pricing benchmarks under specific conditions.

Recent Shocks and Market Reaction

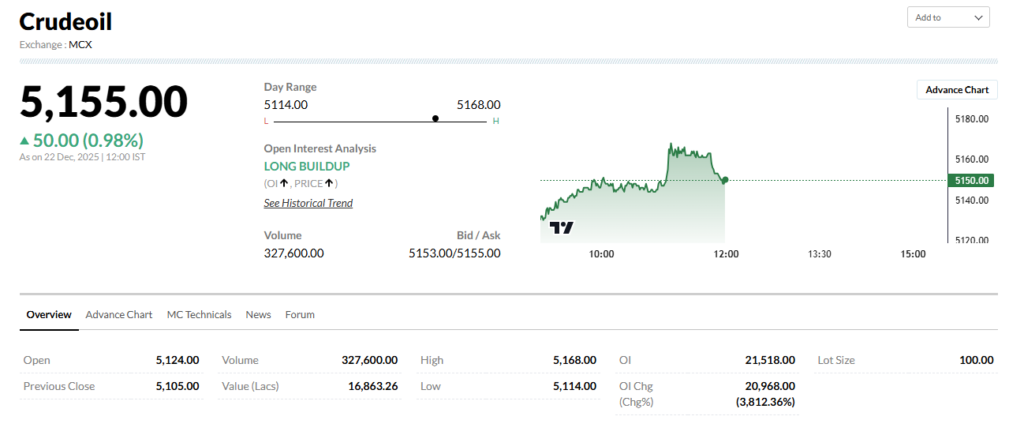

In recent days, oil prices responded to US actions targeting Venezuelan-linked tankers. After the announcement of a blockade and two tanker seizures, Brent crude and West Texas Intermediate futures recorded moderate gains as markets priced in the possibility of reduced exports. Reports indicated price rises in early Asian trading hours when enforcement activity intensified.

These moves did not create a dramatic spike but reflected risk sentiment rather than a sudden supply shortage. Prices typically respond to near-term disruption risk even when the actual volume affected is relatively small in global terms.

Why Markets Are Sensitive Now

Three factors help explain why the impact Venezuela tanker seizures on oil prices appears in market data:

1. Geopolitical risk premium

When enforcement actions are announced, traders tend to incorporate an added risk premium into prices. This reflects uncertainty about future supply flows, not just current output.

2. Export decline expectations

Venezuelan crude exports have reportedly fallen sharply after interdiction efforts, with tankers remaining in Venezuelan waters rather than risk capture. This anticipated decline feeds into forward pricing.

3. Strategic market positioning

Even without large direct supply losses, firms may adjust positions to hedge against extended disruptions, pushing prices higher in the short run.

These factors show how market psychology and expectations influence prices alongside actual flows.

Venezuela’s Role in the Oil Market

Venezuela holds some of the largest proven oil reserves globally and has historically been a significant contributor to regional crude trade. However, recent years of sanctions and production decline have reduced its share in global supply.

Even so, the impact Venezuela tanker seizures on oil prices matters because:

- Venezuelan barrels often travel to specific buyers in Asia and the Caribbean.

- Black-market shipments and “shadow fleet” operations have linked Venezuelan crude to broader illicit oil networks.

Disrupting these flows may not significantly change aggregate global supply, but it affects niche supply lines and pricing dynamics for related grades.

Market Resilience and Limits to Price Impact

Despite the risk premiums seen in recent trading sessions, overall global markets have shown resilience.

Major benchmarks remain around established levels, and some analysts argue that broader crude markets are insulated by oversupply and competitive supply alternatives. Reports citing analytics firms suggest that even heightened enforcement may not meaningfully alter the overall crude price trajectory in the short term.

This resilience stems from two broader conditions:

1. Spare capacity and diversified supply

Global oil markets have access to diversified production sources beyond Venezuela, which softens the impact of localized disruptions.

2. High-volume hedging and futures markets

Futures and derivatives markets often absorb geopolitical noise through financial hedging that prevents large price swings.

Taken together, these factors limit how far the impact Venezuela tanker seizures on oil prices can extend without more systemic supply shocks.

Comparing Past Disruptions

Historical episodes like the oil embargo of 1973 illustrate how acute supply disruptions can sharply elevate prices worldwide. That crisis quadrupled oil prices within a year as supply constraints spread panic in consuming economies.

By contrast, the current situation involves targeted enforcement on a subset of shipments, not an outright cut from a major producer group. That distinction helps explain why price moves have so far been modest, linked more to uncertainty than to fundamental shifts in supply-demand balance.

Regional and Buyer-Specific Impacts

The impact Venezuela tanker seizures on oil prices is more pronounced for specific buyers and regions, notably those that previously relied on Venezuelan crude.

For example:

- China has historically been a significant destination for Venezuelan shipments.

- Regional refiners have adjusted operations in response to disruptions, sometimes diverting cargoes or seeking alternative sources.

These dynamics can create localized pricing effects even if global benchmarks do not show dramatic volatility.

Discounting and Market Adaptation

One emerging trend amid disruption is the widening discount on Venezuelan crude compared with other heavy grades. With interdictions and seizures casting doubt on delivery certainty, sellers and buyers have adjusted pricing expectations accordingly.

This pattern reflects a fundamental market adaptation: when risk increases, uncertainty discounts grow. It can cause certain grades to trade at lower prices, indirectly influencing related crude benchmarks.

Geopolitical Context Beyond Venezuela

Another factor shaping the impact Venezuela tanker seizures on oil prices is the broader geopolitical environment affecting energy flows. While the Venezuela situation itself has a localized effect, other concurrent tensions whether in the Middle East or in relations between major producers and consumers — also influence price expectations.

Markets do not isolate shocks. Interlocking geopolitical events heighten the perception of vulnerability in supply chains, amplifying price sensitivity.

Why This Matters for Consumers and Policymakers

For consumers and policy makers, understanding the impact Venezuela tanker seizures on oil prices helps clarify how localized enforcement action intersects with global energy security.

Policymakers weigh:

- economic costs of sustained enforcement

- risks of escalation with producing states

- potential knock-on effects on inflation and transport costs

For consumers, price sensitivity in gasoline and energy costs can appear even when global crude prices remain moderate.

This makes geopolitical risk management a strategic consideration for both national energy plans and fiscal policy.

Outlook: Price Volatility vs. Structural Stability

Current evidence suggests that the impact Venezuela tanker seizures on oil prices remains measured rather than extreme. Price reactions have been noticeable but not dramatic, driven by risk sentiment and anticipated disruption rather than actual supply shortage at scale.

However, if enforcement broadens, or if Venezuela’s overall production capacity declines further, the market could shift from a psychological response to a structural supply effect.

Analysts will watch:

- changes in Venezuelan export volumes

- developments in tanker traffic behavior

- responses from other producer nations

These variables will help determine whether the present price sensitivity evolves into sustained volatility.

Conclusion

The impact Venezuela tanker seizures on oil prices highlights how geopolitical enforcement actions can influence markets even without major supply disruptions. Price movements thus far reflect heightened uncertainty and adjustments in risk perception.

For now, global oil markets show resilience, but localized pricing effects and risk premiums illustrate the growing influence of geopolitical dynamics on energy economics.

How markets adjust if enforcement persists or broadens will be an important test of energy market stability in the months ahead.

Frequently Asked Questions

Have oil prices risen because of Venezuelan tanker seizures?

Yes, prices have shown modest gains in trading sessions as markets respond to enforcement risk.

Does Venezuela’s export drop affect global supply?

Venezuelan exports have fallen, but the global market has so far been insulated by diversified supply.

Can tanker seizures cause long-term price volatility?

If disruptions persist and force significant production cuts, this could increase long-term volatility.

Are other geopolitical factors influencing oil prices now?

Yes, broader geopolitical tensions and supply uncertainties combine with this situation to shape market sentiment.

ALSO READ: US Oil Tanker Seizure Venezuela Enters New Phase With Third Pursuit

ALSO READ: US Blockade Venezuela Oil and the Shift From Sanctions to Seizures

Pingback: India New Zealand Free Trade Agreement Brings 100% Duty