Key Takeaways

- India spent an estimated $190 billion on crude oil and natural gas imports in fiscal year 2025-26, making it the third-largest global energy consumer.

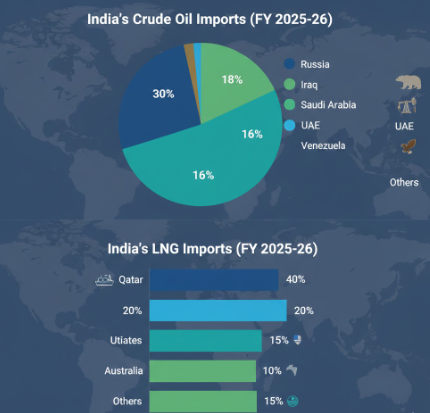

- Russia remains a top supplier (30% of crude), but diplomatic pivots are diversifying the basket to include a resurgence of Venezuelan and renewed Saudi volumes.

- The “Green Transition” is accelerating, but fossil fuels will still constitute over 80% of India’s energy mix by 2030, ensuring import dependency.

India’s quest for energy security in 2026 is a complex dance between soaring domestic demand, volatile global prices, and intricate geopolitical maneuvering. As the world’s third-largest oil importer and a rapidly expanding gas market, India relies heavily on overseas suppliers to fuel its economic growth. This year, the nation is projected to spend approximately $190 billion on crude oil and natural gas imports, a figure that profoundly impacts its trade balance, foreign policy, and domestic energy prices.

The ongoing strategic shift away from an over-reliance on a single supplier (Russia) and the re-engagement with traditional Middle Eastern partners, along with a cautious return to Venezuelan heavy crude, defines the current import landscape.

India’s Major Oil Suppliers: A Diversifying Basket

While India officially aims for an “energy mix” that includes more renewables, the reality is that crude oil remains the lifeblood of its economy, accounting for over 90% of its transportation fuel. The top suppliers have historically been from the Middle East, but recent geopolitical events have reshuffled the deck.

Crude Oil Imports by Country (Fiscal Year 2025-26 Estimates)

Note: These percentages are dynamic and can fluctuate monthly based on global prices, discounts, and geopolitical events.

The Natural Gas Equation

While crude oil dominates the import bill, India’s reliance on imported Liquefied Natural Gas (LNG) is rapidly growing, especially for power generation and industrial feedstock.

LNG Imports by Country (Fiscal Year 2025-26 Estimates)

Impact of Diplomatic Sanctions: The Russian Paradox

The global sanctions regime against Russia, particularly the G7 price cap on crude, initially complicated India’s energy sourcing. However, India adeptly navigated this by becoming a primary buyer of discounted Russian Urals crude, often at $10-20 below Brent.

Key Effects of Sanctions on India

- Discounted Volumes: Sanctions provided a windfall, saving India billions on its import bill.

- Shipping & Insurance Challenges: Reliance on “shadow fleets” and non-Western insurance markets complicated logistics but were ultimately overcome.

- U.S. Pressure & Diversification: In early 2026, a strategic trade deal with the U.S. prompted India to gradually reduce its Russian volumes, leading to a re-engagement with Venezuelan crude and increased dialogue with Saudi Arabia. This is a diplomatic concession aimed at securing broader trade benefits.

The Cost: Total Spend on Energy Resources

The estimated $190 billion spent on oil and gas imports in FY2025-26 represents a substantial portion of India’s total import bill (which was around $670 billion in FY2024-25). This massive outlay has several cascading effects:

- Current Account Deficit (CAD): High energy prices worsen India’s CAD, putting pressure on the Rupee.

- Inflation: Increased import costs often translate to higher domestic fuel prices, fueling inflation.

- Strategic Reserves: India has strategically increased its crude oil reserves to 5.33 million metric tonnes across three locations, providing about 9.5 days of emergency supply. This acts as a buffer against geopolitical shocks.

Future Prospects: The Green Transition and Persistent Demand

Looking ahead to the next five years, India’s energy strategy is dual-pronged: accelerate the green transition while securing traditional fossil fuel supplies.

- Renewable Energy: India aims for 500 GW of non-fossil fuel electricity capacity by 2030, with significant investments in solar and wind.

- Gas-Based Economy: The government plans to increase the share of natural gas in the energy mix from 6% to 15% by 2030, necessitating higher LNG imports.

- Domestic Exploration: Efforts to boost domestic oil and gas production through reforms in the New Exploration Licensing Policy (NELP) are ongoing but face geological and technological hurdles.

The goal is to achieve “energy independence” by 2047, but this remains an ambitious target given the projected growth in demand. India’s energy security will continue to be a blend of diversified imports, strategic diplomacy, and a gradual, but challenging, shift towards sustainable alternatives.

Can India achieve its ambitious green energy targets without jeopardizing its economic growth trajectory, or will fossil fuel imports continue to be the unavoidable bedrock of its industrial might?

Frequently Asked Questions

What percentage of India’s energy demand is met by imports?

Currently, India imports over 85% of its crude oil requirements and nearly 50% of its natural gas needs.

Has India completely stopped importing oil from Russia?

No. India has committed to a “strategic taper,” aiming to reduce Russian oil imports from a peak of 2 million bpd in 2025 to around 800,000 bpd by March 2026, as part of a broader diversification strategy.

Russian vs Venezuelan Crude Oil: Comparing Oil Quality and Prices for India