Executive Summary

- Trump JPMorgan lawsuit 2026 The News: JPMorgan Chase has aggressively pushed back against President Donald Trump’s $5 billion lawsuit, filing a motion on February 19, 2026, to move the case from a Florida state court to federal jurisdiction.

- The Hidden Link: The bank alleges Trump’s legal team “fraudulently” named CEO Jamie Dimon as a co-defendant purely as a legal loophole. By naming Dimon, Trump attempted to anchor the trial in a highly localized, potentially sympathetic Florida state court rather than facing the stricter evidentiary standards of the federal system.

- The Outlook: This case is no longer just about a closed bank account; it is a stress test for the entire US financial sector. If Trump wins, it will effectively criminalize the “reputational risk” matrix that banks use to manage Politically Exposed Persons (PEPs).

When the President of the United States sues the nation’s largest bank for $5 billion, the market takes notice. But when that bank fires back, accusing the President’s legal team of fraudulent maneuvers, it elevates the dispute from a political headline to a constitutional stress test.

In January 2026, Donald Trump sued JPMorgan Chase and its CEO, Jamie Dimon, alleging they “unlawfully debanked and blacklisted” him, his family, and several businesses in the immediate aftermath of January 6, 2021. Trump claims this was a politically motivated exile. JPMorgan claims it was standard regulatory compliance.

Now, the legal chess match has moved to the jurisdictional phase. And the bank is playing offense.

The Core Analysis: The “Fraudulent Joinder” Strategy

To understand why JPMorgan filed Thursday’s motion, you have to look at the mechanics of the US court system.

Corporate defendants hate state courts. State courts often feature local juries, looser evidentiary standards, and elected judges. Federal courts are stricter, more predictable, and better equipped to handle complex corporate law.

For legal purposes, JPMorgan Chase is considered a citizen of Ohio. Because none of the plaintiffs (Trump and his businesses) are Ohio citizens, standard US law dictates the case should automatically qualify for “diversity jurisdiction”—meaning it gets elevated to federal court.

To prevent this, Trump’s lawyers personally named Jamie Dimon as a co-defendant under Florida’s Deceptive and Unfair Trade Practices Act (DUTPA). This is where JPMorgan’s lawyers struck back. In their Thursday filing, they pointed out a glaring statutory flaw: Florida’s DUTPA explicitly exempts officers of federally regulated banks who are acting in their official capacity.

Therefore, JPMorgan argues that Dimon was “fraudulently joined” simply to manipulate the court’s jurisdiction. Furthermore, the bank’s lawyers eviscerated Trump’s claim of a secret banking “blacklist.” They noted the lawsuit provides zero evidence regarding what this blacklist entails, who created it, or how a highly regulated federal bank could possibly circulate such a list without triggering massive internal compliance alarms.

The Historical Parallel: The Farage Effect

We have seen this exact narrative play out across the Atlantic.

In 2023, British politician Nigel Farage was famously “debanked” by Coutts (owned by NatWest). The bank initially cited commercial reasons, but internal documents later revealed they dumped him because his political views did not align with their corporate values. The resulting scandal forced the resignation of NatWest’s CEO and triggered sweeping regulatory changes in the UK regarding banking access.

Trump is attempting to replicate the “Farage Effect” on a $5 billion scale. He is weaponizing the populist anger against corporate ESG (Environmental, Social, and Governance) policies, framing his 2021 account closures not as a regulatory risk-management decision, but as a coordinated ideological attack.

Economic & Geopolitical Ripple Effects

The most fascinating element of this legal war is the glaring geopolitical irony happening behind the scenes.

- The Ultimate Transaction: Even as Trump sues Jamie Dimon for $5 billion, the Financial Times reported this week that JPMorgan is currently in high-level talks to provide the primary banking and payment facilitation services for Trump’s newly established Board of Peace (the organization tasked with the $17 billion reconstruction of Gaza). This proves that at the elite level of global finance, lawsuits and lucrative state contracts are not mutually exclusive.

- The Compliance Nightmare: If the federal courts eventually rule that JPMorgan must pay damages for offboarding Trump, the entire “Know Your Customer” (KYC) industry will panic. Banks routinely close accounts of high-profile individuals if the legal, reputational, or regulatory risks outweigh the profit. If offboarding a politician becomes a liability, banks will simply stop banking politicians altogether.

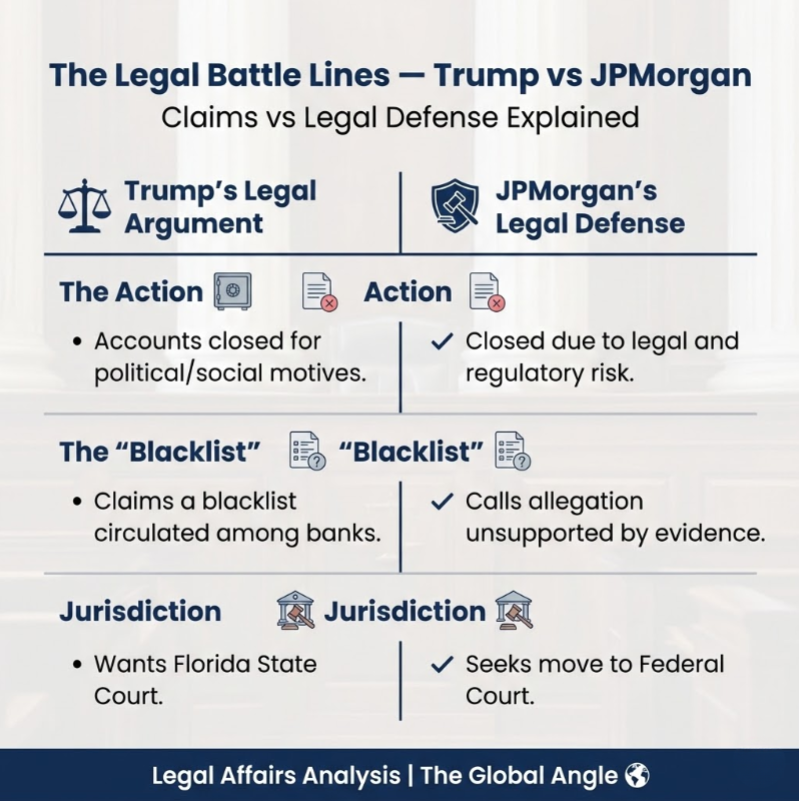

The Legal Battle Lines: Trump vs. JPMorgan

| Metric | Trump’s Legal Argument | JPMorgan’s Legal Defense |

| The Action | The bank closed accounts due to “political and social motivations.” | The bank closed accounts solely due to “legal or regulatory risk.” |

| The “Blacklist” | Alleges Dimon circulated a blacklist to other federal banks. | Calls the claim “threadbare,” citing zero factual evidence of a list. |

| The Jurisdiction | Wants the case in Florida State Court. | Demands a move to Federal Court in Miami (and eventually New York). |

Future Outlook: The Next 6 Months

Watch the federal judge assigned to this Miami district.

If the judge agrees with JPMorgan that Dimon was fraudulently named, Dimon will be dropped from the suit, and the case will be permanently anchored in the federal system. Once in federal court, JPMorgan has already explicitly stated its next move: filing a motion for total dismissal.

Given the strict federal requirements for proving actual “trade libel” and the broad latitude banks are given under the Bank Secrecy Act to close accounts without explanation, Trump faces a steep uphill battle to get this in front of a jury.

Final Verdict: The $5 billion figure is designed for the headlines, but the real war is over where the trial takes place. JPMorgan is systematically dismantling the emotional appeal of Trump’s lawsuit by forcing it into the cold, calculated arena of federal banking law.

Frequently Asked Questions: Trump JPMorgan lawsuit 2026

Why is Trump suing JPMorgan Chase?

President Trump sued the bank and CEO Jamie Dimon for $5 billion, alleging they improperly closed his personal and business accounts in early 2021 for political reasons, effectively “debanking” him following the January 6 Capitol incident.

Why does JPMorgan want the case moved to federal court?

Corporate defendants generally prefer federal courts due to stricter evidentiary rules and less local political bias. JPMorgan argues the case belongs in federal court because the inclusion of Jamie Dimon in the state lawsuit was a “fraudulent” legal tactic that violates Florida statute exemptions for federal bank officers.

Did JPMorgan actually create a ‘blacklist’ for Trump?

JPMorgan strongly denies this. In their legal filings, the bank called the blacklist allegation “threadbare,” noting that Trump’s legal team provided no details on what the list is, who saw it,

ALSO READ: Munich Security Conference 2026 takeaways: A World “Under Destruction” or Reconstruction?