Executive Summary

- Trump new 10% global tariff The News: In a massive 6-3 decision, the US Supreme Court struck down President Donald Trump’s sweeping global tariffs. Within hours, the White House invoked a rarely used 1974 law to enact a temporary, flat 10% global import surcharge effective February 24, 2026.

- The Hidden Link: The ruling accidentally handed a massive short-term win to India. The 18% reciprocal tariff recently negotiated in an interim US-India trade deal was legally wiped out by the court, dropping India’s baseline rate to the new 10% global standard.

- The Outlook: Global supply chains face extreme volatility. While US importers prepare legal battles for up to $160 billion in potential refunds, shipping rates will likely spike as companies aggressively frontload cargo before this new 150-day tariff expires in July.

On Friday, the global economic landscape was thrown into chaos. A landmark US Supreme Court decision dismantled the legal architecture of Donald Trump’s second-term trade policy, declaring his use of emergency powers to tax the world unconstitutional.

But the victory lap for foreign exporters and US businesses was incredibly short-lived. By Friday evening, the Oval Office had pivoted, signing an executive order to blanket the globe with a new 10% tariff.

This rapid-fire legal maneuvering has created a deeply complex environment for international trade. Here is the unvarnished breakdown of what the Supreme Court actually did, the real reason India’s tariffs suddenly plunged, and how this 150-day window will shock global markets.

The Core Analysis: IEEPA vs. Section 122

To understand the current chaos, you have to look at the underlying legal statutes.

Last year, Trump imposed massive tariffs on allies and adversaries alike using the International Emergency Economic Powers Act (IEEPA) of 1977. Chief Justice John Roberts, writing for the 6-3 majority, stated that IEEPA was designed to freeze foreign assets during national security crises, not to give the Executive Branch a blank check to rewrite tax codes without Congressional approval.

Faced with the immediate invalidation of his core economic agenda, Trump pivoted to a never-before-used tool: Section 122 of the Trade Act of 1974.

This law allows a president to unilaterally impose an import surcharge of up to 15% to address a “large and serious United States balance-of-payments deficit.” Trump set the rate at 10%. However, Section 122 has a massive catch: it is strictly limited to 150 days. After five months, it expires unless Congress actively votes to extend it.

The Indian Angle: The Real Reason Behind the 18% to 10% Cut

One of the most fascinating ripple effects of this legal drama involves India.

Just weeks ago, the US and India reached a framework for an interim trade deal. Trump agreed to drop punitive 50% and 25% tariffs on India (initially triggered by New Delhi’s purchase of Russian oil) down to a reciprocal 18%.

When the Supreme Court struck down the IEEPA tariffs on Friday morning, the legal basis for that 18% rate vanished instantly. Because Trump’s new Section 122 order mandates a flat, uniform global surcharge to balance international payments, he cannot legally single out India for a higher 18% rate under this specific statute.

Consequently, the White House confirmed that Indian goods will now face the lower 10% rate. While Trump publicly stated, “Nothing changes, they’ll be paying tariffs… we did a little flip,” the reality is that the Supreme Court forced his hand. Indian exporters just received an unexpected 8% discount on US-bound goods, giving them a significant, temporary pricing edge in labour-intensive sectors like textiles and manufacturing.

Trump new 10% global tariff: Economic & Geopolitical Ripple Effects

The shift from permanent emergency tariffs to a 150-day temporary surcharge completely alters the math for global logistics.

- The $160 Billion Refund Mess: The US Treasury has already collected over $130 to $160 billion under the now-illegal IEEPA tariffs. Companies like Costco and Alcoa are lining up for refunds, but the Supreme Court kicked the actual refund mechanism back to the Court of International Trade. Expect years of grueling corporate litigation.

- The “Frontloading” Shock: Because the 10% Section 122 tariff expires in 150 days, the Trump administration has admitted they will use this time to launch specific country-by-country investigations under Section 301 (which targets unfair trade practices). Fearing that tariffs will skyrocket back to 20% or 40% in July, global retailers will frantically “frontload” their holiday inventory now. This will likely trigger a massive spike in transpacific ocean freight rates by April.

- Trade Deal Fractures: The White House expects countries like the UK, Japan, and the EU to honor the concessions they made during recent trade negotiations, even though the US just altered the tariff rates. Partner nations may use the Supreme Court ruling as leverage to abandon those deals entirely.

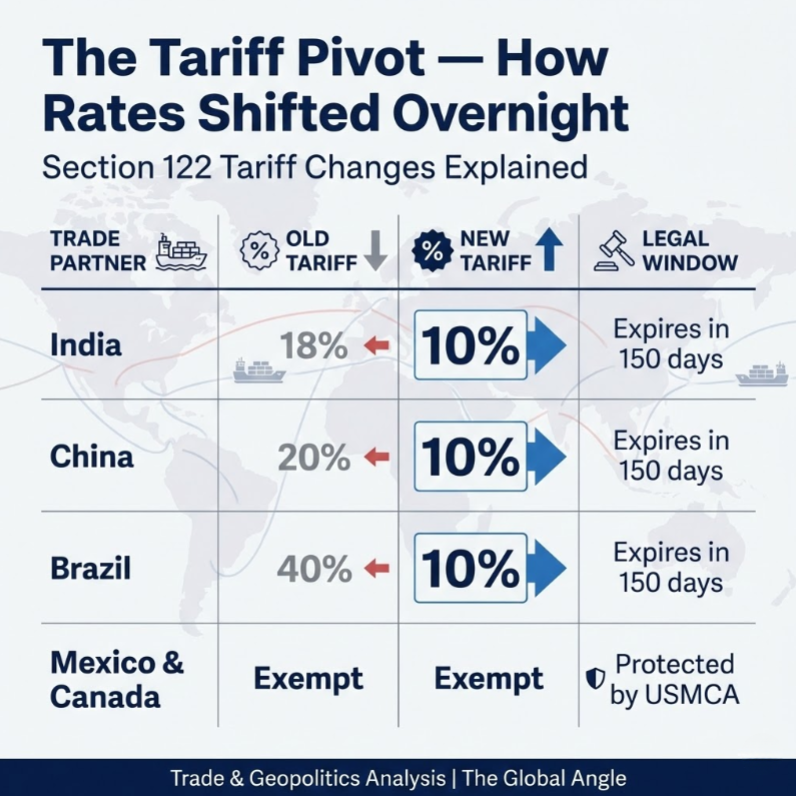

The Tariff Pivot: How Rates Shifted Overnight

| Trade Partner | Pre-Ruling Tariff (Under IEEPA) | New Tariff (Section 122, Feb 24) | Legal Window |

| India | 18% (Interim Trade Deal) | 10% | Expires in 150 Days |

| China | 20% (Including Fentanyl Levies) | 10% | Expires in 150 Days |

| Brazil | 40% | 10% | Expires in 150 Days |

| Mexico & Canada | Exempt (USMCA) | Exempt | Protected by USMCA |

Future Outlook: The Next 150 Days

The clock is now ticking. Watch the US Department of Commerce closely over the next three months.

They must work at breakneck speed to finalize Section 301 investigations against major manufacturing hubs like China, Vietnam, and India before the Section 122 authority expires in late July. If those investigations stall, Trump will face a catastrophic cliff where global tariffs suddenly drop to zero, right in the middle of the midterm election cycle preparations.

Final Verdict: The Supreme Court may have ended Trump’s unchecked tariff authority, but they did not end the trade war. They simply compressed it into a frantic, highly volatile five-month window.

Frequently Asked Questions

Why did the Supreme Court strike down Trump’s global tariffs?

In a 6-3 ruling, the court determined that the International Emergency Economic Powers Act (IEEPA) of 1977 does not grant the president the authority to unilaterally impose broad import taxes. Chief Justice John Roberts noted that the power to tax is constitutionally reserved for Congress.

What is Section 122 of the Trade Act of 1974?

It is a rarely used trade law that allows the US President to temporarily impose an import surcharge of up to 15% to address fundamental, international balance-of-payments deficits. However, the tariff can only remain in effect for a maximum of 150 days.

Will US businesses get refunds for the old tariffs they paid?

While the Supreme Court ruled the original tariffs illegal, it did not outline a refund process. The issue will be handled by the US Court of International Trade, and economic analysts expect the process to involve lengthy and complicated litigation for importers trying to recoup the estimated $160 billion collected.

ALSO READ: The 2026 India-EU Free Trade Agreement :”Mother of all deals or A Loophole to enter India”

ALSO READ: Trump JPMorgan lawsuit 2026: Why JPMorgan is Moving Trump’s Lawsuit to Federal Court

Trump new 10% global tariff: Why India’s Tariff Dropped to 10% After Trump’s Supreme Court Defeat

Executive Summary Trump new 10% global tariff The News: In a massive 6-3 decision, the…

Google Gemini 3.1 Detailed Review and Comparison: Decoding the Gemini 3.1 Upgrade and the February Outage

Executive Summary Google Gemini 3.1 Review The News: Google has officially rolled out Gemini 3.1…

The 2026 India-EU Free Trade Agreement :”Mother of all deals or A Loophole to enter India”

Executive Summary (The “Global Angle”) The News: On January 27, 2026, after two decades of…

Trump JPMorgan lawsuit 2026: Why JPMorgan is Moving Trump’s Lawsuit to Federal Court

Executive Summary Trump JPMorgan lawsuit 2026 The News: JPMorgan Chase has aggressively pushed back against…

Trump’s Board of Peace: The $1 Billion Geopolitical Club Explained

Executive Summary Trump’s Board of Peace The News: U.S. President Donald Trump has officially convened…

India AI Impact Summit Day 3 Summary: Google’s Subsea Cable, $50B Pledges & The Viral Exit Chaos

Executive Summary India AI Impact Summit Day 3 summary The News: Day 3 of the…