Key Takeaways

- The Big Shift in US Trade 2026: Mexico remains America’s top trading partner, with the “friend-shoring” trend cementing North American supply chain dominance over China.

- The Deficit Reality: The U.S. continues to run a massive Goods Deficit (importing physical products) of over $1 Trillion, partially offset by a robust Services Surplus of ~$330 Billion.

- Rising Stars: Vietnam has surged to become a primary source of electronics and textiles, running the third-largest deficit with the U.S., right behind China and Mexico.

In the complex world of global economics, the US Trade Deficit remains the ultimate scorecard of consumption versus production. As we analyze the data from late 2025 and early 2026, a clear picture emerges: the United States is buying heavily from its neighbors and strategic allies, while its service economy continues to be a global export engine.

This report provides a data-driven look at who the US trades with, where the money is going, and which sectors are driving the numbers.

1. Trade Alliances: Who Does the US Trade With?

The geopolitical landscape has reshuffled the deck. The USMCA (United States-Mexico-Canada Agreement) bloc is now the dominant force. The most significant story of 2026 is the “decoupling” from China, whose share of U.S. imports has dropped significantly due to tariffs and diversification.

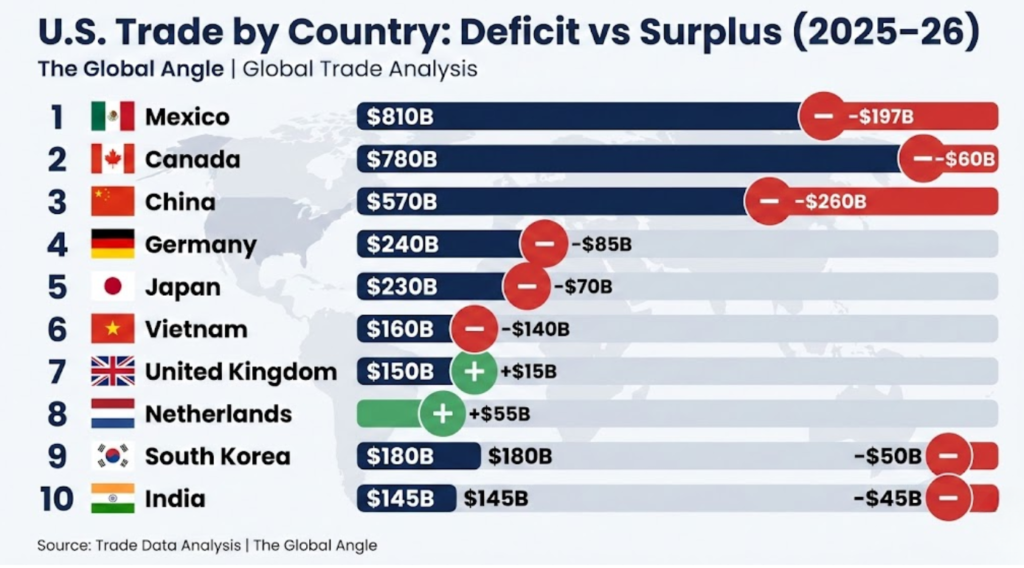

Top US Trade 2026 Partners & Balance (2025-2026 Estimates)

Data reflects annualized estimates based on Census Bureau & BEA reports through late 2025.

| Rank | Partner Country | Total Trade (Imports + Exports) | Trade Balance Status | Net Deficit/Surplus (Approx) |

| 1 | Mexico 🇲🇽 | $810 Billion | Deficit | -$197 Billion |

| 2 | Canada 🇨🇦 | $780 Billion | Deficit | -$60 Billion |

| 3 | China 🇨🇳 | $570 Billion | Deficit | -$260 Billion |

| 4 | Germany 🇩🇪 | $240 Billion | Deficit | -$85 Billion |

| 5 | Japan 🇯🇵 | $230 Billion | Deficit | -$70 Billion |

| 6 | Vietnam 🇻🇳 | $160 Billion | Deficit | -$140 Billion |

| 7 | United Kingdom 🇬🇧 | $150 Billion | Surplus | +$15 Billion |

| 8 | Netherlands 🇳🇱 | $120 Billion | Surplus | +$55 Billion |

| 9 | South Korea 🇰🇷 | $180 Billion | Deficit | -$50 Billion |

| 10 | India 🇮🇳 | $145 Billion | Deficit | -$45 Billion |

Analyst Note: The deficit with Vietnam is disproportionately high compared to its total trade volume. This confirms Vietnam’s role as the new “assembly hub” for electronics and apparel that used to come from China.

2. Sector Breakdown: Where is the Money Going?

To understand the deficit, we must look at what is being traded. The US is a net importer of physical “stuff” but a net exporter of “expertise.”

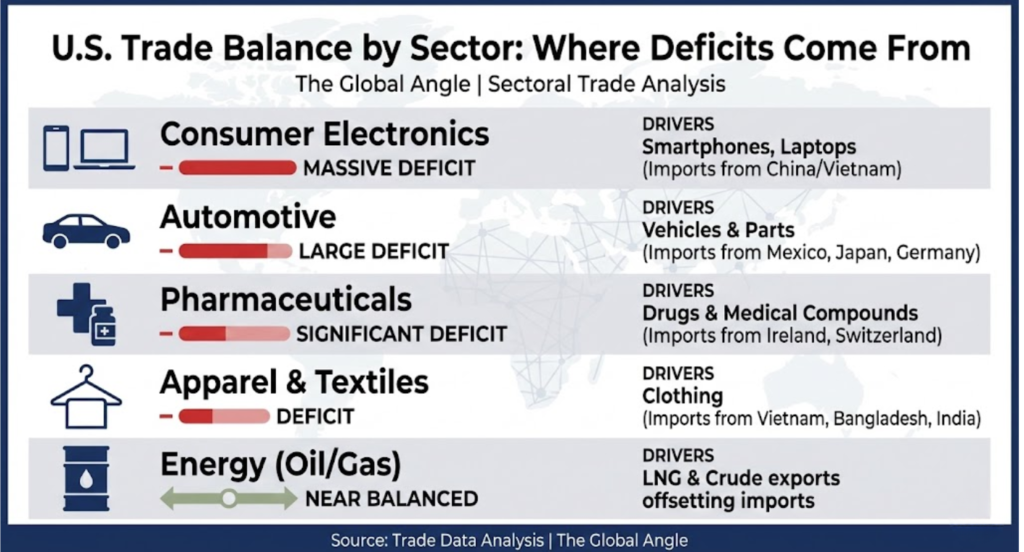

The “Goods” Deficit (Physical Products)

The US runs a structural deficit here. Americans consume far more manufactured goods than the country produces domestically.

| Sector | Import/Export Status | Key Drivers |

| Consumer Electronics | Massive Deficit | Smartphones, Laptops (Imports from China/Vietnam). |

| Automotive | Large Deficit | Vehicles & Parts (Imports from Mexico, Japan, Germany). |

| Pharmaceuticals | Significant Deficit | Drugs & Medical compounds (Imports from Ireland, Switzerland). |

| Apparel & Textiles | Deficit | Clothing (Imports from Vietnam, Bangladesh, India). |

| Energy (Oil/Gas) | Near Balanced | The US now exports huge amounts of LNG/Crude, offsetting imports. |

The “Services” Surplus (The Hidden Strength)

While the news focuses on factories, the US dominates in intangible sales. This surplus helps stabilize the dollar.

| Sector | Import/Export Status | Key Drivers |

| Financial Services | Surplus | Banking, Insurance, Consulting (Sold to UK, EU, Asia). |

| Intellectual Property | Surplus | Royalties for movies, software, and patents. |

| Travel & Education | Surplus | Foreign students paying tuition in US; Tourists visiting US. |

| Aerospace | Surplus | Civil Aircraft (Boeing) remains a top export sector. |

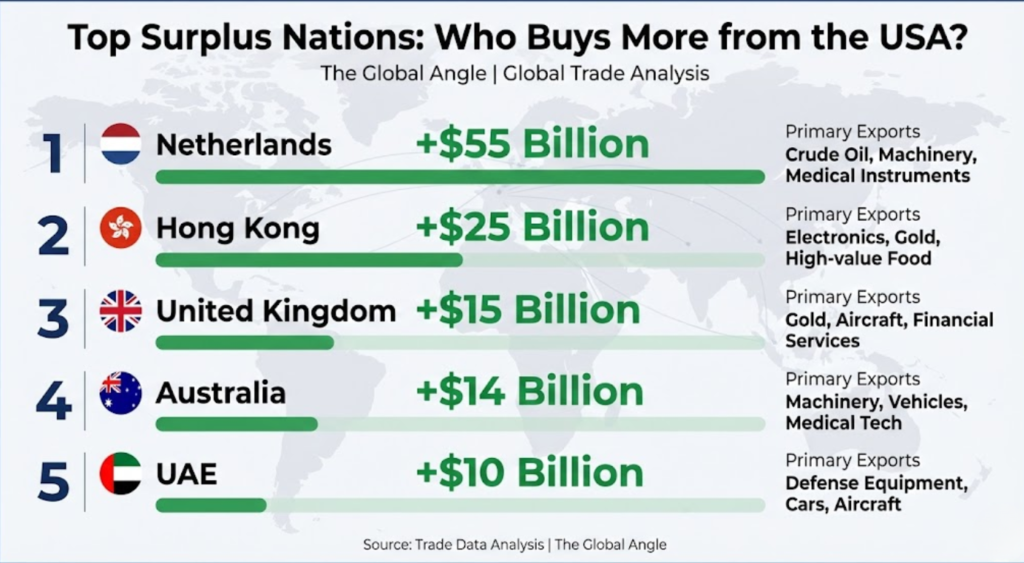

3. Top Surplus Nations: Who Buys More From the USA?

It is a myth that the US runs a deficit with everyone. Several wealthy, developed nations buy more American goods and services than they sell.

| Rank | Country | Surplus Amount (Approx) | Primary US Exports |

| 1 | Netherlands 🇳🇱 | +$55 Billion | Crude Oil, Machinery, Medical Instruments. |

| 2 | Hong Kong 🇭🇰 | +$25 Billion | Electronics, Gold, High-value Food. |

| 3 | United Kingdom 🇬🇧 | +$15 Billion | Gold, Aircraft, Financial Services. |

| 4 | Australia 🇦🇺 | +$14 Billion | Machinery, Vehicles, Medical Tech. |

| 5 | UAE 🇦🇪 | +$10 Billion | Defense Equipment, Cars, Aircraft. |

Emerging Trends in 2026

The “Friend-Shoring” Effect

The data clearly shows a move away from geopolitical rivals.

- China’s Decline: High tariffs and tech restrictions have reduced the volume of direct trade. China is no longer the top trading partner, a title it held for over a decade.

- Mexico’s Manufacturing Boom: Proximity and the USMCA free trade deal have turned Mexico into the US’s primary factory floor, especially for automotive and appliances.

The Pharmaceutical Anomaly

One of the fastest-growing deficits is with Ireland and Switzerland. This isn’t about cars or toys; it’s about high-value pharmaceuticals. Many US pharma giants manufacture drugs in these countries for tax and logistical reasons, then import them back into the US.

Frequently Asked Questions (FAQ)

Is a trade deficit bad for the US economy?

Not necessarily. A deficit often means the US economy is strong, with consumers wealthy enough to buy goods from around the world. However, a persistent deficit can lead to higher national debt over time.

Why is the deficit with Vietnam so high?

This is largely due to companies moving assembly lines from China to Vietnam to avoid US tariffs. The goods are still intended for the US market, but the “origin” label has changed.

Does the US export oil?

Yes. The US is now a major exporter of crude oil and LNG, particularly to Europe (Netherlands, UK) and Asia. This has drastically reduced the “energy deficit” that plagued the US economy in the 2000s.

ALSO READ: The $1.2 Trillion Shift: Complete China Trade Surplus 2026 Breakdown

ALSO READ: Russian vs Venezuelan Crude Oil: Comparing Oil Quality and Prices for India

The End of “Free Leverage”: How RBI’s 2026 Guidelines Are Reshaping the Broking Industry

Executive Summary (The “Global Angle”) The News: The Reserve Bank of India (RBI) has issued…

The Thermal Masterstroke: Why the 2026 F1 Championship Could Be Decided in Court

F1 vs Mercedes key takeaways – The News: The FIA has launched an emergency e-vote…

Winter Olympics 2026 “A New Era”: How Milano Cortina Rewrote the Olympic Playbook

Winter Olympics 2026 key notes – The News: As the Milano Cortina 2026 Winter Games…

Andrew Mountbatten-Windsor arrest 2026: Why This Redefines Royal Immunity

Executive Summary Andrew Mountbatten-Windsor arrest 2026 The News: On his 66th birthday (February 19, 2026),…

Yoon Suk Yeol life sentence: The Dec 2024 Insurrection & The “Pardon Cycle”

Executive Summary Yoon Suk Yeol life sentence The News: A Seoul court has sentenced former…

India AI Impact Summit Day 2 Summary: The Day the “AI Hype” Broke the Doors Down

Executive Summary India AI Impact Summit Day 2 Summary The News: Day 2 of the…