3 Major Impacts of Venezuelan Oil to India in 2026

The global energy landscape is shifting as the United States prepares to market Venezuelan Oil to India. Following the US capture of President Nicolas Maduro in early January 2026, the Trump administration has introduced a new framework for managing the world’s largest oil reserves. For India, this represents both a diplomatic challenge and a massive economic opportunity.

The New US-Controlled Framework for Venezuelan Oil to India

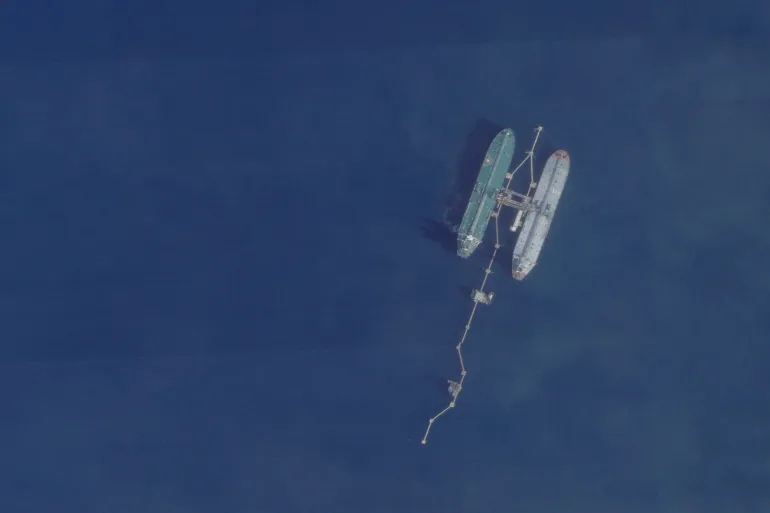

Washington is currently finalizing a system where the US government oversees the marketing and revenue of all Venezuelan crude. Energy Secretary Christopher Wright confirmed that while the oil will flow to countries like India, the funds will be placed in US-controlled accounts. This ensures the money benefits the Venezuelan people rather than a specific regime.

Reliance Industries is already in active discussions with the US State and Treasury departments. The goal is to secure a permit to resume imports of Venezuelan Oil to India. This move is crucial as the US increases pressure on New Delhi to reduce its reliance on Russian crude.

Venezuelan Oil Supply and Market Data 2026

| Category | Statistics/Details | Impact Level |

| Current Output | 750,000 Barrels Per Day | Moderate |

| Projected 2027 Output | 1.4 Million Barrels Per Day | High |

| Reserve Size | Over 300 Billion Barrels | Global Scale |

| New Export Deal | 30 to 50 Million Barrels | Immediate |

Impact on Indian Refineries and Market Margins

India is uniquely positioned to benefit from the return of Venezuelan Oil to India. Many Indian refineries, particularly those owned by Reliance in Gujarat, are highly complex. They are specifically designed to process the heavy and “sour” crude grades found in Venezuela, such as the Merey blend.

By switching from expensive or politically risky Russian barrels to discounted Venezuelan crude, Indian refiners can significantly improve their margins. This transition helps diversify India’s energy basket and provides a shield against the 500% tariffs threatened by the US on Russian oil buyers.

Comparison of Crude Sources for India

| Feature | Russian Crude (Urals) | Venezuelan Crude (Merey) |

| Geopolitical Risk | Very High (US Tariffs) | Managed (US Framework) |

| Processing Difficulty | Medium | High (Requires Complex Refineries) |

| Freight Cost | High (Long Distance) | High (Requires Diluents) |

| Price Outlook | Discounted | Deeply Discounted |

What This Means for the Indian Economy

The resumption of Venezuelan Oil to India could help stabilize domestic fuel prices over the long term. As supply increases under US management, global crude prices may experience downward pressure. For a country that imports 85% of its oil, any drop in the global benchmark is a major win for the fiscal deficit.

Furthermore, this deal may help Indian firms like ONGC Videsh recover nearly $1 billion in legacy dues. These funds have been stuck in Venezuela for years due to previous sanctions. The new US oversight provides a legal pathway for these dividends to finally reach Indian state-run companies.

Conclusion

The deal for Venezuelan Oil to India is more than just a trade agreement; it is a total realignment of energy power. As India balances its ties between Washington and Moscow, the arrival of South American crude offers a much-needed alternative. The success of this framework will depend on how quickly the infrastructure in Caracas can be repaired.

Do you think India should completely stop buying Russian oil if Venezuelan supplies become stable?

Is Venezuelan Oil to India currently active?

As of January 2026, Reliance and other refiners are seeking specific US permits to resume regular shipments.

Why does the US control the money from these sales?

The US framework ensures that oil revenues are used for humanitarian needs rather than corruption or regime support.

Can all Indian refineries process this oil?

No, only complex refineries like those owned by Reliance and Nayara Energy are technically suited for heavy Venezuelan crude.

How much oil is involved in the initial deal?

The US and Caracas have reached a deal to move approximately 30 to 50 million barrels of stored crude immediately.

ALSO READ: Trump Says Venezuela Will Give Oil to U.S: What Changes for Energy and Diplomacy

ALSO READ: US Quarantine of Venezuelan Oil Signals New Phase in Pressure on Maduro