Key Takeaways

- The Latest Rejection: Warner Bros Discovery (WBD) officially rejected Paramount Skydance’s $30-a-share hostile bid on February 17, 2026.

- The One-Week Window: WBD has given Paramount a strict deadline of February 23 to submit a “best and final” offer, hinted to be above $31 per share.

- The Netflix Factor: Despite engaging with Paramount, WBD’s board still recommends the existing $82.7 billion merger deal with Netflix, set for a shareholder vote on March 20.

Warner Bros Paramount Netflix Deal 2026: The battle for Hollywood’s crown jewels—from Batman to Harry Potter—has entered its final, most dramatic act. On Tuesday, February 17, 2026, Warner Bros Discovery sent a clear message to Paramount Skydance: “Not good enough, but try one last time.”

This saga, involving three media giants, activist investors, and billions in financing from tech mogul Larry Ellison, is reshaping the global entertainment landscape. Here is the complete history and current status of the war for Warner Bros.

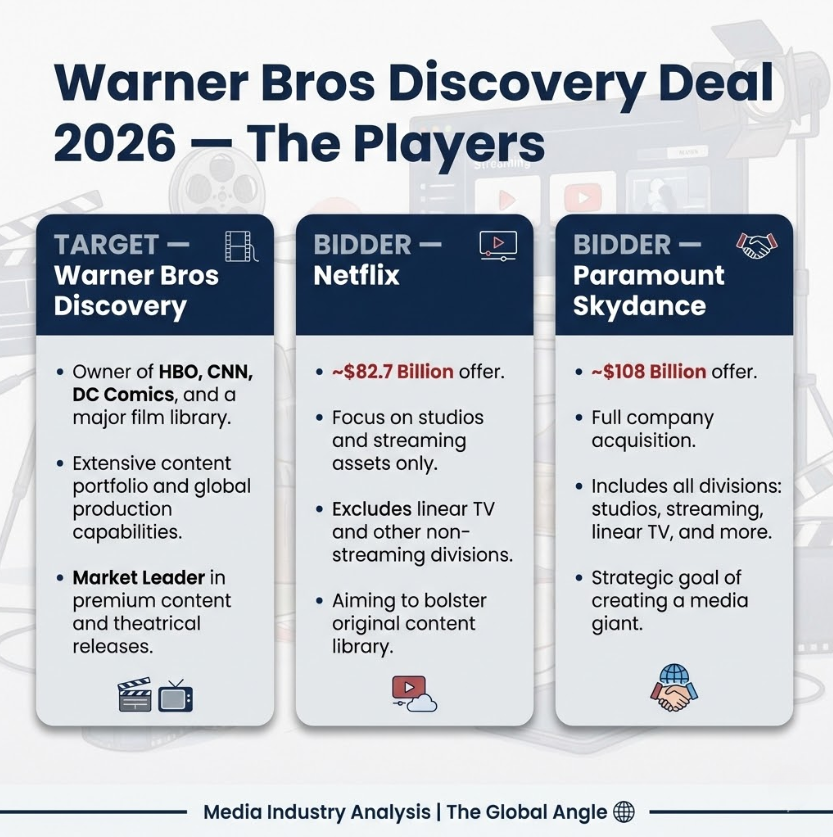

Warner Bros Paramount Netflix Deal 2026: The Players

- Target: Warner Bros Discovery (WBD) – Owner of HBO, CNN, DC Comics, and a massive film library.

- Bidder 1 (The Favorite): Netflix – Offering $27.75/share ($82.7 billion) for WBD’s studios and streaming only (excluding cable news).

- Bidder 2 (The Challenger): Paramount Skydance – A consortium led by David Ellison, offering ~$108 billion for the entire company.

Timeline of the Saga

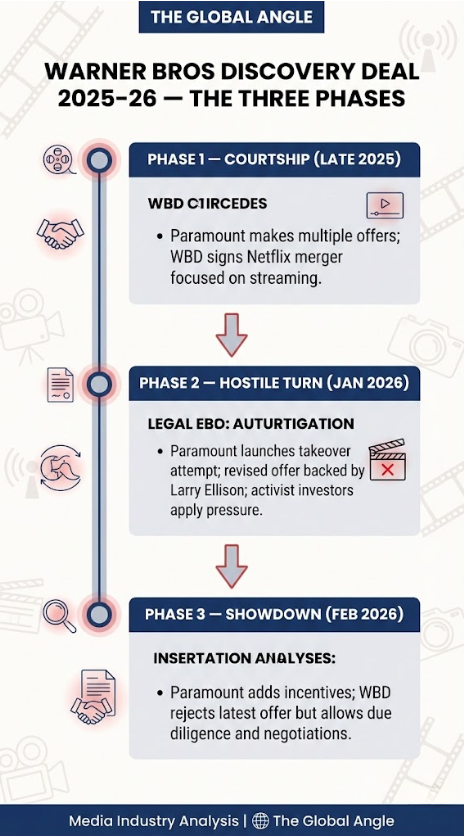

Phase 1: The Courtship (Late 2025)

- Pre-December 2025: Paramount Skydance executives make six different offers to acquire Warner Bros. According to Paramount, the WBD board “never meaningfully engaged” with these proposals.

- December 5, 2025: In a massive industry shift, Warner Bros announces a definitive merger agreement with Netflix. The deal focuses on combining their streaming dominance while spinning off WBD’s linear cable assets (CNN, TNT, Food Network).

Phase 2: The Hostile Turn (Jan 2026)

- Late December 2025: Feeling spurned, Paramount launches a hostile takeover bid days after the Netflix announcement. It is swiftly rejected.

- Early January 2026: Paramount returns with a revised offer, bolstered by a personal guarantee of $40 billion in equity from Oracle founder Larry Ellison. WBD rejects this again, citing financing uncertainty.

- Activist Pressure: Ancora Holdings and Pentwater Capital Management (owning ~50 million WBD shares) begin pressuring the board, arguing that the Paramount deal—which buys the whole company—is superior to the Netflix asset-split.

Phase 3: The Showdown (Feb 2026)

- Feb 13, 2026: Paramount makes a new attempt, offering “ticking fee” cash sweeteners and agreeing to cover the $2.8 billion breakup fee WBD would owe Netflix.

- Feb 17, 2026 (Current Status): WBD rejects the latest $30/share offer but acknowledges an informal verbal float of $31/share.

- The Deadline: WBD grants Paramount a waiver to conduct due diligence and submit a “superior” proposal by February 23.

- The Conditions: The WBD board explicitly questions Paramount’s debt financing and demands a deal that is fully guaranteed by Larry Ellison’s equity if banks back out.

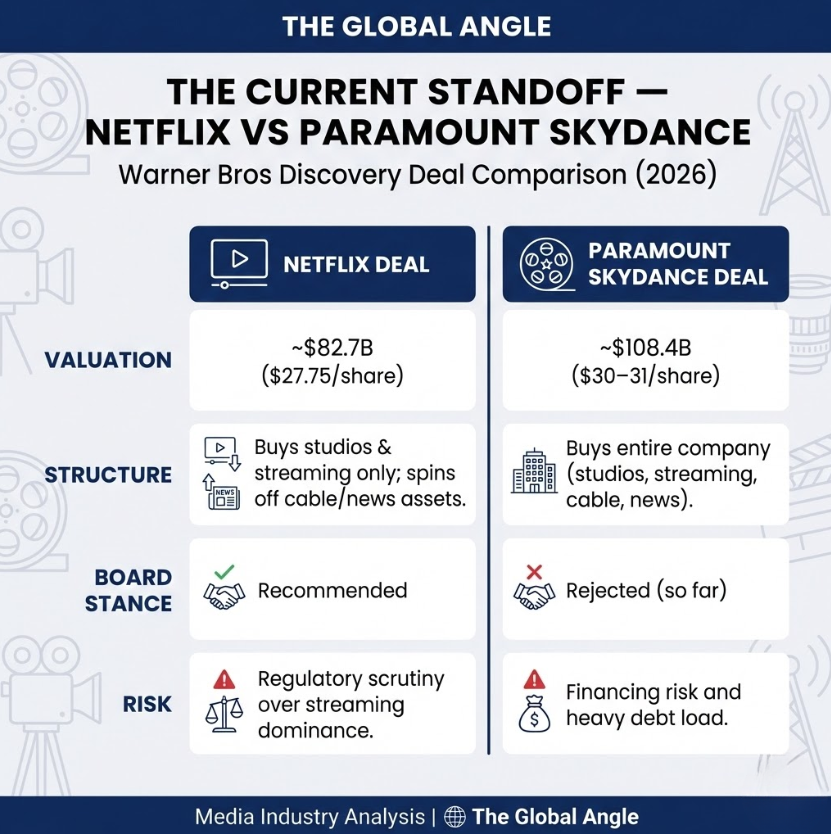

The Current Standoff: Netflix vs. Paramount

The choice for Warner Bros shareholders is stark.

| Feature | Netflix Deal | Paramount Skydance Deal |

| Valuation | $82.7 Billion ($27.75/share) | $108.4 Billion ($30-31/share) |

| Structure | Buys Studios & Streaming only. Spins off CNN/Cable into a new public co. | Buys the Entire Company (Studios, Streaming, Cable, News). |

| Board Stance | Recommended | Rejected (So far) |

| Risk | Regulatory scrutiny on streaming monopoly. | Financing risk; heavy debt load. |

What Happens Next?

- Feb 23 Deadline: Paramount must submit its absolute final offer. If it hits the $31-$32 range and secures ironclad financing guarantees, the WBD board may be legally forced to declare it a “Superior Proposal.”

- Netflix’s Move: Under the merger rules, Netflix has the right to match any offer Paramount makes.

- March 20 Vote: Regardless of the back-and-forth, WBD shareholders are scheduled to vote on the Netflix merger. If Paramount fails to sway the board by then, the Netflix deal will likely proceed.

Conclusion

The WBD board remains skeptical, stating, “Our Board has not determined that your proposal is reasonably likely to result in a transaction that is superior.” However, with activist investors like Ancora breathing down their necks and the stock market reacting positively to a bidding war (Paramount shares up 6%), the next seven days will decide the fate of Hollywood’s most iconic studios.

Is cash king, or is the strategic fit with Netflix too good to pass up? We find out on February 23.

Frequently Asked Questions

Why does Warner Bros prefer the Netflix deal?

WBD’s leadership, including CEO David Zaslav, believes the Netflix deal offers more certainty and creates a streaming juggernaut without the “financing risks” associated with Paramount’s debt-heavy bid.

What happens to CNN in these deals?

- Netflix Deal: CNN and other cable channels (TNT, HGTV) get spun off into a separate, independent public company.

- Paramount Deal: CNN would likely be absorbed into the broader Paramount Global portfolio, potentially merging news operations with CBS News.

Who is backing the Paramount bid?

The bid is led by Skydance Media (David Ellison) but is heavily backed by his father, Larry Ellison (Oracle founder), who has offered personal equity guarantees to fund the acquisition.

ALSO READ: Amazon $450 billion market value loss 2026: Lessons from Jeff Bezos’ 2000 “Ouch” Letter

ALSO READ: Munich Security Conference 2026 takeaways: A World “Under Destruction” or Reconstruction?

The End of “Free Leverage”: How RBI’s 2026 Guidelines Are Reshaping the Broking Industry

Executive Summary (The “Global Angle”) The News: The Reserve Bank of India (RBI) has issued…

The Thermal Masterstroke: Why the 2026 F1 Championship Could Be Decided in Court

F1 vs Mercedes key takeaways – The News: The FIA has launched an emergency e-vote…

Winter Olympics 2026 “A New Era”: How Milano Cortina Rewrote the Olympic Playbook

Winter Olympics 2026 key notes – The News: As the Milano Cortina 2026 Winter Games…

Andrew Mountbatten-Windsor arrest 2026: Why This Redefines Royal Immunity

Executive Summary Andrew Mountbatten-Windsor arrest 2026 The News: On his 66th birthday (February 19, 2026),…

Yoon Suk Yeol life sentence: The Dec 2024 Insurrection & The “Pardon Cycle”

Executive Summary Yoon Suk Yeol life sentence The News: A Seoul court has sentenced former…

India AI Impact Summit Day 2 Summary: The Day the “AI Hype” Broke the Doors Down

Executive Summary India AI Impact Summit Day 2 Summary The News: Day 2 of the…